Since it was announced on June 18th, Facebook’s Libra coin has attracted a lot of attention. I haven’t read many of the comments about it, and decided to first read the white paper myself, in order to get a somewhat unbiased idea about it. I say ‘somewhat unbiased’ because I have been working in the field of monetary systems for too long now to avoid all biases. The big question is: “What value does the Libra bring to its myriad of stakeholders?”

For those who have missed all the hype, Libra is a new cryptocurrency, as announced by Facebook. Indeed, Facebook will not govern it all by themselves, but is setting up a non-profit organisation, the ‘Libra Association’, together with representatives from organisations such as PayPal, Visa, Mastercard and others, which are all listed in the white paper.

Libra coins can be obtained by buying them from authorised resellers, which I shall refer to as ‘resellers’ for the rest of this article. These resellers have to buy the coins from the Libra Association. The act of buying the Libra coins from the Libra Association results in the creation (minting) of the Libra coins. Exchanging Libra coins back into regular currencies also goes through these resellers. The resellers on their part can sell coins back to the Libra Association if they wish, thereby destroying (burning) them.

Once the coins are brought into circulation through the resellers, they can be used for trade with organisations and businesses who are willing to accept the Libra as currency. They might also be used for speculation, which is what mainly happened with Bitcoin.

Setting trust issues with a company like Facebook aside, a first impression of the white paper comes across as fairly positive. The claim that it would save a lot of people from loan sharks by giving them easy access to a sort of bank account is very likely to be achievable. However, that depends on how eager Libra resellers are to extend cheap loans to poor people in developing countries. There is no guarantee whatsoever that the classical loan sharks would not be replaced by Libra loan sharks. However, because competition on those markets would cross borders, that problem might get solved by itself.

The fact that the technology underpinning the Libra coin is made open source is very good news. That way, the open source community can learn from the advances made by the Libra blockchain technology and can either build on it or apply it to other projects. It is bound to attract a lot of attention from developers, which can only be interpreted as good news for the crypto world at large. Of course, any contributions to the Libra framework by the open source community will also benefit the core founders of the Libra coin.

Things become more complicated when it comes to the acclaimed “value stability” of the Libra coin. The white paper claims that the exchange rate of the coin will remain stable thanks to the backing of low risk financial assets. These financial assets include bank deposits and government securities in currencies from stable and reputable central banks, amongst others. From my perspective, this “value stability” claim cannot be upheld, at least not for everyone.

“Because the reserve will not be actively managed, any appreciation or depreciation in the value of the Libra will come solely as a result of FX market movements.”

The above is a literal quote from the Libra reserve paper. Add to that the fact that the Libra is not pegged to any currency in its basket and you get the situation where its trade value is fully dependant on market forces which, as we all know, can be very unpredictable.

The paper on the Libra reserve is full of good intentions to protect consumers from currency volatility. However, no concrete regulations are mentioned. Pegging the Libra to the average or median of the currencies in the basket would be, for example, a concrete protection, but it is literally stated that the Libra Association does not determine monetary policy, thereby leaving everything to the resellers.

These resellers are partially protected against losses because they will always get a minimum price for their Libra from the Libra Association. However, this is not the case for the users of the Libra since for them the exchange rate is set by the market. Furthermore, that exchange rate can either be a lot higher or a lot lower than the exchange rate the resellers obtain for it, depending on demand and the profit structures of the resellers.

The claim that a ‘bank run’, a situation where everyone wants to get rid of their Libra as fast as possible to minimise losses, can never happen is therefore only technically true. The resellers are guaranteed that every Libra they hold is backed by the Libra Association, which plays the role of the Libra Central Bank.

However, the resellers sell their Libra at market value, which will probably be higher than what they pay for it themselves, and can buy them back in at a lower rate than what they sell them for. If the price were to plummet, resellers have the liberty to protect themselves from losses by paying far less for a Libra than what they can get from the Libra Association. This could trigger a ‘bank run’ on the resellers.

This means that the claim of full backing by the reserve only counts for the resellers, and not for the users. The only way to protect against that would be to set maximum and minimum exchange rates for resellers close to the value of the reserve divided by the amount of Libra coins in circulation. However, that would mean the value of the Libra needs to be pegged to the value of the reserve and that’s setting a monetary policy from which the Libra association explicitly refrains.

Regular currency exchange is supervised under the Forex market regulations. It isn’t mentioned anywhere that the Libra currency exchange falls under these same regulations, thereby limiting regulations to what the Libra Association and the authorised resellers manage to agree on. This could be problematic. The Libra Association is set up as non-profit, but I would be very surprised if the authorised resellers would not be for-profit organisations, which will most likely try to keep regulation as far away from maximising profits as possible.

Let me introduce you to the Libra Investment Token. It is only mentioned once in the document about the reserve and the Libra Association document elaborates on it in more detail.

This is a token, and, in essence, a second coin. Investors can acquire these tokens by investing a minimum of ten million dollars. In the initial phase, up until the Libra is officially launched, this makes them a founding member.

Investment tokens will also be sold at a later time when additional funding is needed. This token then entitles the holder to receive dividends from the reserve fund. These dividends are gained from the interest that is generated by investing the money in the reserve fund. The interest is first used to pay for the costs of running the association, the Libra currency system and to invest in further development. The rest is partially paid out as dividends to those holding investment tokens.

At first sight, one might think that these dividends will be small because the investments are low risk and are thus likely to have low yields. However, you have to keep in mind that the goal is to turn the Libra into a world currency, which means that scale starts to play a significant role should they succeed.

The supply of these tokens is limited. Initially they are only handed out to the initial investors and will only be issued afterwards if additional funding is required.

If the Libra successfully turns into an accepted world currency, then the holders of these investment tokens stand to gain huge profits due to the size of the reserve. This would mean that the non-profit character of the Libra Association is just a nice facade for a money making machine that mainly benefits the for-profit organisations that started it.

The Libra Association consists of two power entities (the council and the association board), an executive entity (the association executive entity) and an advisory entity (the social impact advisory board).

The council holds most of the power, including overruling decisions taken by the association board. The members of the council coordinate the technical roadmap of the system, in collaboration with the open source community; they manage the reserve, allocate funds and elect and remove members of the association board. The association board plays the role of an oversight body. More details on the roles can be found in the document of the Libra Association.

The members of the council initially include only the founding members. They have each pledged a minimum of ten million dollars to the reserve in exchange for investment tokens.

These founding members are also the only members who validate transactions on the blockchain when the Libra is brought to market. Entities that validate transactions are called validator nodes. Initially only founding members act as validator nodes but a transition path is described in which other entities can also serve as validator nodes at a later stage. The key is the financial stake. The financial stake in the Libra is initially only determined by the amount of investment tokens one holds. At a later date, holding a sufficient amount of Libra will also count towards this financial stake.

Voting power is also determined by the financial stake one holds in the Libra. Every investment of ten million dollars gains you one vote.

The number of votes is capped in order to limit power concentration. For founding members, i.e., those holding sufficient investment tokens, this cap is set to one percent of the votes or one vote, whichever is greater. If a founding member were to hold more votes than the cap allows, the excess voting power has to be given to the Libra Association board, which may delegate the votes to other entities under conditions listed in the Libra Association document. These votes can be given to entities which do not meet the ten million dollars investment requirement.

It is not quite clear from the document whether investors who hold a sufficient amount of investment tokens, but do not act as a validator node, also hold voting power. Reading between the lines, I assume that one needs to be a validator node in order to have voting power, although I’m not totally sure of this.

For those not holding investment tokens, voting power can only be acquired by acting as a validator node, and either holding an adequate financial stake with the custody of Libras, once these start counting towards the financial stake, or by being lucky enough to acquire excess votes through delegation by the Libra Association board.

The number of active validator nodes is limited, and thereby the size of the council is limited too. It is the council itself which decides on this limit, and if the number of active validator nodes should exceed this limit, the member with the least number of votes is removed. In case of a tie, the member with the shortest continuous membership is removed.

Voting is carried out by either a regular majority or a super majority, consisting of at least two thirds of the votes. A super majority is required for:

It takes some time to get your head around the text presented in the Libra Association document, but the power structure that has been setup gives a lot of leeway for power games, mainly played by the more affluent players.

Voting power for social impact organisations which cannot cough up the required ten million dollars’ entry fee is dependent on the goodwill of the association board to be handed surplus voting power.

This board is elected by those holding the lion’s share of power. The limit on active validator nodes, along with the procedure for removal of surplus validator nodes, ensures that those who have invested the most, and have been there the longest, will hold on to their seats of power. In essence, the message is, “Trust us; we’re the good guys,” although there is nothing that can be done if that promise proves to be false.

What about the users of the Libra coin? They are crucial for the success of the currency and they will be the main source of funding for the reserve, and thus also for the profits made from that reserve by those that hold investment tokens. However, users hold no power unless they are able to invest sufficiently in Libra.

The Libra is a non-interest bearing currency which means that users forfeit all interest they could have gained on their normal currency. This is unless, of course, someone would be willing to pay an interest on Libra coin accounts, yet if someone would be willing to do that, you can bet that they will be making a far larger profit than they are paying out.

Current interest rates are virtually non-existent, except for those sitting on a lot of money. However, you have to keep in mind that the non-interest bearing Libra is backed by interest bearing financial assets.

Indeed, that interest, which is more than the average Joe can receive on a savings account, is not going into the pockets of the users. It is stated literally in the document of the reserve that users do not receive a return from the reserve.

If Libra truly wants to help people to stabilise their finances then they could have distributed half of the dividends amongst its users, even in Libra, and thus implement a basic income, yet they categorically chose not to do that. This turns users into assets for the investors of the Libra and they bear the brunt of the risk.

There is also the question of what would happen when the Libra becomes the most used currency in a country where there are currency problems, such as Turkey, for example. The exchange rate of the Turkish Lira has been on a downwards slope for years, leading to high inflation. What if the Turks dumped their Lira in exchange for Libra en masse? This could crash the value of the Lira even further and could have potentially disastrous effects on the banking system of the country. How would that affect the political independence of that country? What would it do to the local economy? One of the goals, as stated in the white paper, is the following:

“We believe that global, open, instant, and low-cost movement of money will create immense economic opportunity and more commerce across the world.”

This implies more international consumption, which could mean a boon for the investor’s international trade balances, but it could be disastrous for local trade. Unless local merchants also switch to the Libra, further damaging the value of the national currency. In that event, what about taxes? Would the Turkish government be forced to accept taxes in Libra or would the Turkish Lira mainly be used for taxes and will the Libra be used for all other purposes? I’m not going to delve into this further, but I thought that it at least needed to be mentioned in a critical article on the Libra.

Although there are a lot of great promises that are advertised by Facebook and the other founding members of the Libra, I’m personally very sceptical about it. Other than the promises, I see nothing that truly guarantees protection of Libra coin users against exploitation, except maybe the fact that exploiting the users is bad for business for the members of the Libra Association. This is because they stand to make a lot of profit from this initiative should they succeed in their goal of making the Libra into an accepted world currency.

I do see a lot of safeguards for the early investors and the resellers though. In the end, should the initiative fail, the losses are minimal. The investors would have access to the developed technology on which they can build other projects. They would have gained a tremendous insight into monetary policy and legislation which can also be used for future projects. The cost of setting up the non-profit organisation is very little and there is virtually no investment in hardware because the initial investors already have the infrastructure needed to set this up. The money that is not used is held in a secure fund which is managed by all the players that put their money into it. Therefore, it is not so hard to imagine that, in the case of utter failure, this fund will be redistributed according to the amount of investment tokens each investor holds.

Should it fail, those who stand to lose the most are the users. There is no guarantee that the resellers will still be willing to buy Libra if their profit margins for doing so fall below certain thresholds. The coins in circulation will then only be useful if the validator nodes, which are run by the initial investors for the foreseeable future, are still up and running. However, there are no guarantees for that and when the risk of validator node shutdown looms it becomes very unlikely that people will still be willing to accept Libra for their goods and services. The open source community could possibly help out there if they set up a parallel structure and offered to exchange Libra to ‘new Libra’. I think it would be a good idea to have that in place from the beginning.

Furthermore, all the Libra which die together with the last validator node would mean extra profits for the founding members because they won’t have to buy them back.

I realise that I’m painting a worst case scenario here and I don’t know how things will evolve. Only time will tell though, and I believe that painting a worst case scenario is necessary because it opens up pathways to improve on what is there and to mitigate the known risks.

At Happonomy, part of our mission is to help organisations design money so it aligns with those things we find truly valuable in a better way.

So here’s our feedback to the Libra founders: if you are truly interested in creating value for those who have no access to bank accounts and cheap loans, we suggest doing the following:

To end on a positive note, maybe the critique published by myself and others could help to shape the final version of the Libra. If not, the developed technology could be useful for the open source community and might one day become the foundation for something that truly has value creation for everyone at its core.

string(3) "yes" NULLSuMSy is a theoretical monetary model which has the assumed capacity to change the shape of the economic ecosystem in such a way that it puts the wellbeing of people and the planet at its core. We acknowledge that this model has not yet been tested in real life situations and that all the claims which are made in relationship to SuMSy are assumptions until further research has been carried out. However, he assumptions made are extrapolated from related and peer reviewed research and research-based literature.

The core claims we make are as follows:

The way in which money is brought into and taken out of circulation has an influence on the behaviour of the people using it and it nudges them in predictable ways. Built in mechanics can nudge people further towards predictable behaviours. It is our responsibility that these nudges serve the common good.

Implementing SuMSy would install a form of ‘governance by incentive’ and would require less rules and regulations to keep excesses in check. It would cause a rise in the wellbeing of both people and the planet, while at the same time creating a stable, sustainable economy.

The model has been inspired by both the story of Wörgl in Austria in the early 1930’s and by the basic income movement and the various basic income experiments that have been implemented. The initiative in Wörgl and the experiments with a basic income both had positive impacts on the communities in which they were active.

The following list identifies the challenges SuMSy which aims to tackle:

The idea emerged after looking into the reasons why it seemed to be so hard to solve our climate change problem even though we knew what to do and how to do it. The search eventually led to the current monetary system being the main blocker and cause, due to the incentives it creates for acquiring large sums of money. This is because, once enough money has been gathered, it will almost automatically attract more money without actually adding real value to society. More often than not this profit seeking behaviour creates a disregard for environmental and human costs.

On July 15, 2016 the Guardian published an article by Jason Hickel which stated that, in order to combat climate change, we need to create a new economic system, rather than just switching to renewable energy. Creating that new economic system is what this proposition is all about. Let’s first have a look at where the flaws in our current system lie.

Our current capitalistic economic system is one of acquisition. Its goal is to acquire capital in its many forms. Real estate, factories, patents, web companies, etc., and ultimately the one to rule them all: money.

All these assets are perceived to be scarce. If you want something, you can’t allow someone else to have it as well, because there is not enough for both of you. This creates unhealthy competition and a world where the ‘get as much profit as possible’ business model is king. If you don’t make more profit every year, then your business will be branded as a failure. “Grow, grow, grow!” is the mantra of the day. This mentality is literally costing lives!

Real lifesaving projects, such as the one that wants to create cheap, paper based blood-testing devices to be used in developing countries get left in the dust because they are not profitable enough. In a world where perceived scarcity runs the show, it’s all about collecting as much as possible, where greed is the only outcome. We all know how that pans out; it’s a destructive force that eats away at our naturally helpful nature. It even has a measurable effect on three year olds. However, it doesn’t have to be this way. We created the current economic system, which means that we can also change it.

An economic system, at its core, consists of goods and services that are traded. Usually, a monetary system is used to facilitate that trade. Economists will say that this is oversimplification and they’re right; that is, if we want to talk about the full complexity of economic systems. Yet, if we take away goods and services, there won’t be much of an economy left.

The complexities of the economic system arise from the wants and needs that are associated with these goods and services, and the design of the monetary system, if one is used. An economy runs in a society. People are needed in order to have economic activity, even if those people use computers and robots to perform that activity for them (e.g. smart trading algorithms on Wall Street).

Since it ultimately comes down to running a well-functioning society through economic and other activities, it suffices to look at which economic activity is needed in order to have this well-functioning society. In other words, which goods and services need to be passed around (i.e. traded) in order to keep everyone happy?

The primary goods are clean water, food and shelter. Without water or food, people would just die, and without shelter, life can get very harsh, depending on where they live.

There is currently no real shortage of either clean water or food, yet people starve from hunger, die from a lack of clean water, and then the countless homeless people who are sleeping on the streets all over the world are not even mentioned. The reason for this is obvious really; it is because those people don’t have enough access to money. If they had, it would open the doors to clean water, nutritious food and decent shelter. Neoliberalists claim that these people just don’t work hard enough and if they were prepared to work, they’d be lifted out of poverty in no time. Nick Hanauer states it differently in his TED talk where he says that luck is a major factor in your success. The money is just an agreement on what is used to represent real value.

The biggest problem with capitalism is that it inherently makes money flow from the poor to the rich. This is shown in the following statistics:

Money has a strong tendency to flow to the financial world. Once it gets there, it just moves around in circles, adding no real value to society All it really does is increase the wealth of the wealthy.

The entire financial world is actually a huge pile of money just sitting there, doing nothing but shifting place from one pocket to the next. Of course, a little bit trickles down to the rest of society again, but obviously not as much as is being sucked into it. Otherwise, it would be hard to explain the distribution of money in our world today. Here’s a small excerpt of those numbers:

If trickle-down economics could really be a boon for society, these numbers should be more in balance. Why is this? The answer is fairly simple; hoarding money is rewarded with more money. Yes, this is a simplified statement, but once you get your hands on your first couple of million, it becomes ever easier to increase that amount if you play the financial markets correctly. When you have enough to spare, you can spread your risks and make sure that there’s no real danger of losing it all.

Neoliberals argue that these people invest in businesses. Yes, they do, but only if they can make a profit from them. More often than not, a successful startup eventually turns into a money machine for just a few people.

Take Uber for example. Who is getting rich from the Uber business model? Is it the drivers or the people at the top? Once again, most of the money flows to those with pools of money already. This is a mostly a one-directional flow, which is bad news if you’re on the wrong end of it.

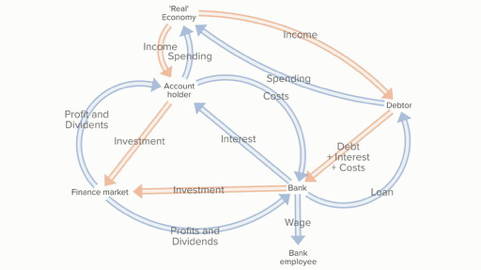

Figure 1 – Monetary flows in capitalism

The above graph paints a clear picture. Debtors and bank employees are also account holders, but are displayed as separate entities to keep things clear. The ‘real’ economy is the market of product and service providers which are not related to the financial market. Every member of this ‘real’ economy is also an account holder. The money which a debtor receives on his/her account is created by the bank, from debt with an interest. When the debt is payed back, this money is destroyed again together with the debt. The interest is profit for the bank.

For a debtor, the income flow must be higher than the spending flow if they want to be able to pay back the loan. That surplus on the income flow is at least partly used to pay for the interest on the loan and the bank costs. This process extracts money from the ‘real’ economy.

An account holder must make sure that the sum of their income, interest on their account and their profits and dividends are at least as high as their spending. Otherwise, they will become a debtor. If their income is high enough they can save some money for later. Once the sum that is saved reaches a certain volume, the likelihood that it will be invested in the financial market rises due to the low to non-existent interest that is gained on bank accounts these days.

If interest rates were high, the money would just be kept in the bank, which also results in it ending up in the financial markets (see below). Once this happens, most of the profits and dividends have a high likelihood of being reinvested in financial products, thereby keeping money in the financial markets.

Also note that, if the income is largely received through the ‘real’ economy, part of that money now flows through to the financial markets. Interest on loans, and profits and dividends from financial investments received by the bank which are not spent on wages and operating costs are also mainly reinvested in the financial markets.

Banks also use a large part of their managed deposits for this purpose. This is possible because banks are not obligated to keep the total sum of all their money in the accounts they manage available as reserve. This means that a lot of the money that people think is in their bank account is actually running around the financial market. As can be seen, unless money is forced out of the financial markets, it has a strong tendency to flow towards this financial market where most of it remains. This impoverishes the ‘real’ economy.

Although the model presented here is simplified, it still captures the core flows of the current monetary system. It’s easy to see how the flows depicted by the orange arrows all contribute to helping money reach the financial markets. Once it reaches those, it tends to stay there. One could conclude that the financial markets are a dead end for monetary flows. It is clear that the current driving forces of our economic system have destructive effects on the society at large. It’s this observation that has led to the design of SuMSy so that a new, more stable and fairer economic ecosystem can emerge, one where a real flow of money is achieved, without dead ends.

For a short recap, watch the video below.

SuMSy is an alternative monetary system with the following characteristics:

This section describes the technical components of SuMSy. 1 SuMSy Coin or SC in SuMSy is the equivalent of 1 coin in the current monetary system. In the US 1 SC = 1$, in Europe 1 SC = 1€, …

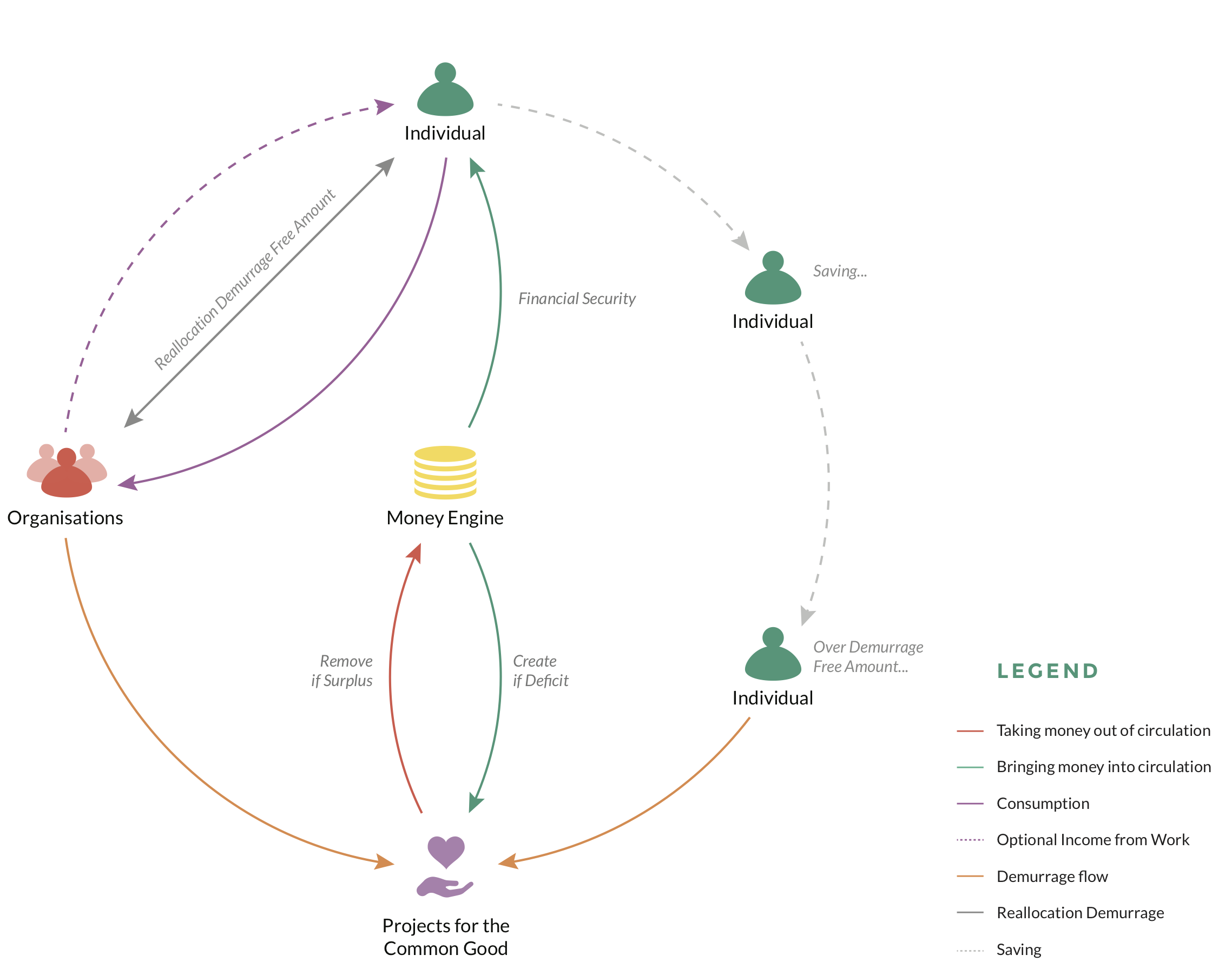

The money engine sits at the core of SuMSy. This money engine can create money to be brought into circulation and can take surplus money out of circulation.

Every person is linked to exactly one digital identity in SuMSy. This identity is used to link that person to everything else in SuMSy.

Everyone starts with one account, which is linked to their digital identity. Everyone can create as many additional accounts as they want. Accounts can also be shared with others. This happens by linking them to their digital identities. In this way, an account is always linked to 1 or more digital identities. People whose digital identities are linked to an account are the custodians of that account.

When an account is shared, each individual’s stake in the account must be declared. The sum of all stakes must always equal 100%.

SuMSy is a monetary system without interest on accounts. However, there is a cost to holding on to money. The demurrage free amount is the set amount for which people do not have to pay in order to hold on to money. Above this limit, it costs something to hold on to money. The demurrage free amount is tied to the digital identity and is the same for everyone. By default, the entire demurrage free amount is attributed to the first account that is linked to the digital identity. The person to whom the digital identity belongs is free to spread this demurrage free amount across as many accounts as they wish, even accounts they are not linked to.

Money is brought into circulation in either of two ways:

A guaranteed income. The guaranteed income is linked to the digital identity and is the same for everyone on an annual basis. The person to whom the digital identity belongs can allocate this guaranteed income to the accounts to which their digital identity is linked. By default, the entire guaranteed income is linked to the first account that is linked to the digital identity. The guaranteed income is deposited periodically on the linked accounts according to the spread chosen by the owner of the digital identity. The period can be monthly, weekly or even daily and does not have to be the same for everyone. The guaranteed income is deposited immediately after the demurrage fee (see below) is subtracted from the account(s).

Projects for the common good. Projects for the common good are projects that are indispensable for, or support a well-functioning society which ensures the wellbeing of people and planet. These include – although are not limited to – education, healthcare, environmental preservation, etc. Not all funding for projects for the common good needs to be brought into circulation out of the central money pool though. They are also funded through demurrage fees and taxes. See below for further details.

As mentioned previously, holding on to money above the demurrage free amount is not free in SuMSy. When an account’s balance rises above the demurrage free amount allocated to it, a demurrage fee is charged on the amount above this demurrage fee. The demurrage fee is a percentage of that amount. It is collected just before the guaranteed income is brought into circulation and deposited on the accounts.

Calculation of the Demurrage Fee

The weighted average of the account is calculated. This is done by looking at the balance over the period since the last guaranteed income has been deposited and assigning a weight to each balance which is equal to the time that balance remained unchanged.

The weighted balance is calculated using the following formula:

Sum(balance1 * weight1, …, balanceN * weightN) / total weight.

The demurrage fee is calculated from this weighted average.

For example: Let’s assume that everyone has a demurrage free amount of 25,000 SC. For simplicity, we use a day as the time unit (in reality, we would use a microsecond or even a nanosecond as the time unit) and the period over which the demurrage fee is calculated is 30 days. Let’s take someone who has allocated the full 25,000 SC demurrage free amount to one account and they have 27,000 SC in it initially.

A sample of transactions could look like this:

| Day | Transaction | Balance | Weight | Weighted total |

| 1 | 27,000 SC | 2 | 54,000 SC | |

| 3 | 300 SC | 27,300 SC | 4 | 109,200 SC |

| 7 | -5,000 SC | 22,300 SC | 8 | 178,400 SC |

| 15 | 3,200 SC | 25500 SC | 4 | 102,000 SC |

| 19 | 5,500 SC | 31,000 SC | 1 | 31,000 SC |

| 20 | -4,800 SC | 26,200 SC | 2 | 52,400 SC |

| 22 | -200 SC | 26,000 SC | 7 | 182,000 SC |

| 29 | -700 SC | 25,300 SC | 2 | 50,600 SC |

| Average weighted balance (weighted total/30) | 25,320 SC |

With a demurrage fee of 2%, calculated on the how much the average weighted balance is above the demurrage free amount, 320 in the example above, the amount of money that is taken out of the account is 6.4 SC.

The collected money is used to fund the projects for the common good. Everyone who pays demurrage fees can appoint preferred projects to which their demurrage fees are allotted. We believe that this would lower the resistance to paying the demurrage fee and create a sense of ownership towards the projects to which the money is assigned. We also believe that it adds to the sense that people contribute to something larger than themselves, which plays a key role in mental wellbeing.

Using the demurrage fee in this way has an immediate effect on the amount of money that needs to be brought into circulation for these projects. It could be seen as a method of recycling the money collected from the demurrage fee.

We propose a tiered demurrage fee system, similar to the tiered tax systems for labour. When using a tiered demurrage fee system, the sum of all demurrage susceptible amounts across all accounts needs to be calculated because otherwise the incentive would be there to create extra accounts in order to avoid the higher demurrage tiers. This also needs to include shared accounts. For shared accounts only a percentage of that sum, equal to the stake in the account, would be added to the total sum on which demurrage is calculated.

Example:

Joe has one individual account and a shared one with Cynthia in which he holds a 40% stake. He has allocated 10,000 SC of his demurrage free amount to this shared account. Cynthia has allocated 5,000 SC of her demurrage free amount to this shared account. The state of the accounts at the time the demurrage is calculated is as follows:

|

Since Joe holds a 40% stake in the shared account, he only needs to pay demurrage on 6,000 of the 15,000 SC susceptible to demurrage, bringing his total amount on which he has to pay demurrage to 18,000 SC. It is this amount that is used to determine tiered demurrage fees.

In SuMSy, taxes are no longer a necessity in order to fund governance activities when all governance activities have the goal to serve the common good. This would be inherent to governance models which run on top of this monetary model. However, taxes are still useful because they can be used to discourage unsustainable behaviour such as pollution, destroying natural resources, and so on. Money collected from taxes is also used to fund chosen projects for the common good, in the same way as money is collected from the demurrage fees.

Continuously bringing new money into circulation would eventually lead to hyperinflation. Therefore, there also needs to be a mechanism to take money out of circulation. This happens when a project for the common good is overfunded. All the surplus money for a project for the common good is taken out of circulation. This ensures there is a soft upper limit to the total amount of money circulating in SuMSy because there are a finite number of projects for the common good, all with finite budgets.

Technically, money collected through taxes and demurrage fees could be taken out of circulation, since money needed for projects for the common good can be brought into circulation as needed. For psychological reasons, we have decided not to do this. We believe that giving people a chance to appoint that money to preferred projects would create a sense of ownership and involvement in society which would not happen when the money is simply taken out of circulation. Publishing the funding numbers for each project on a continuous basis would probably also contribute to this as it would serve as a feedback system to the population.

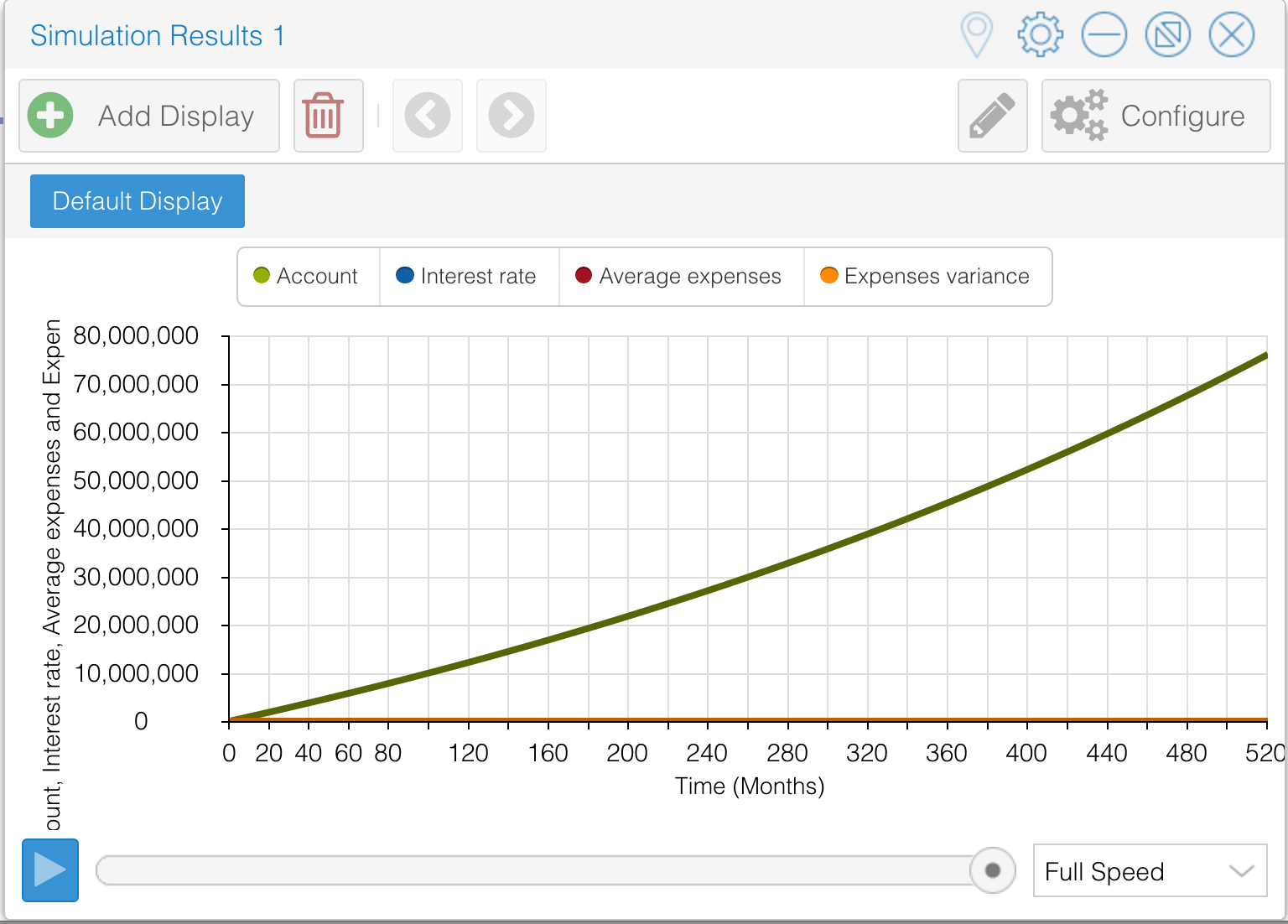

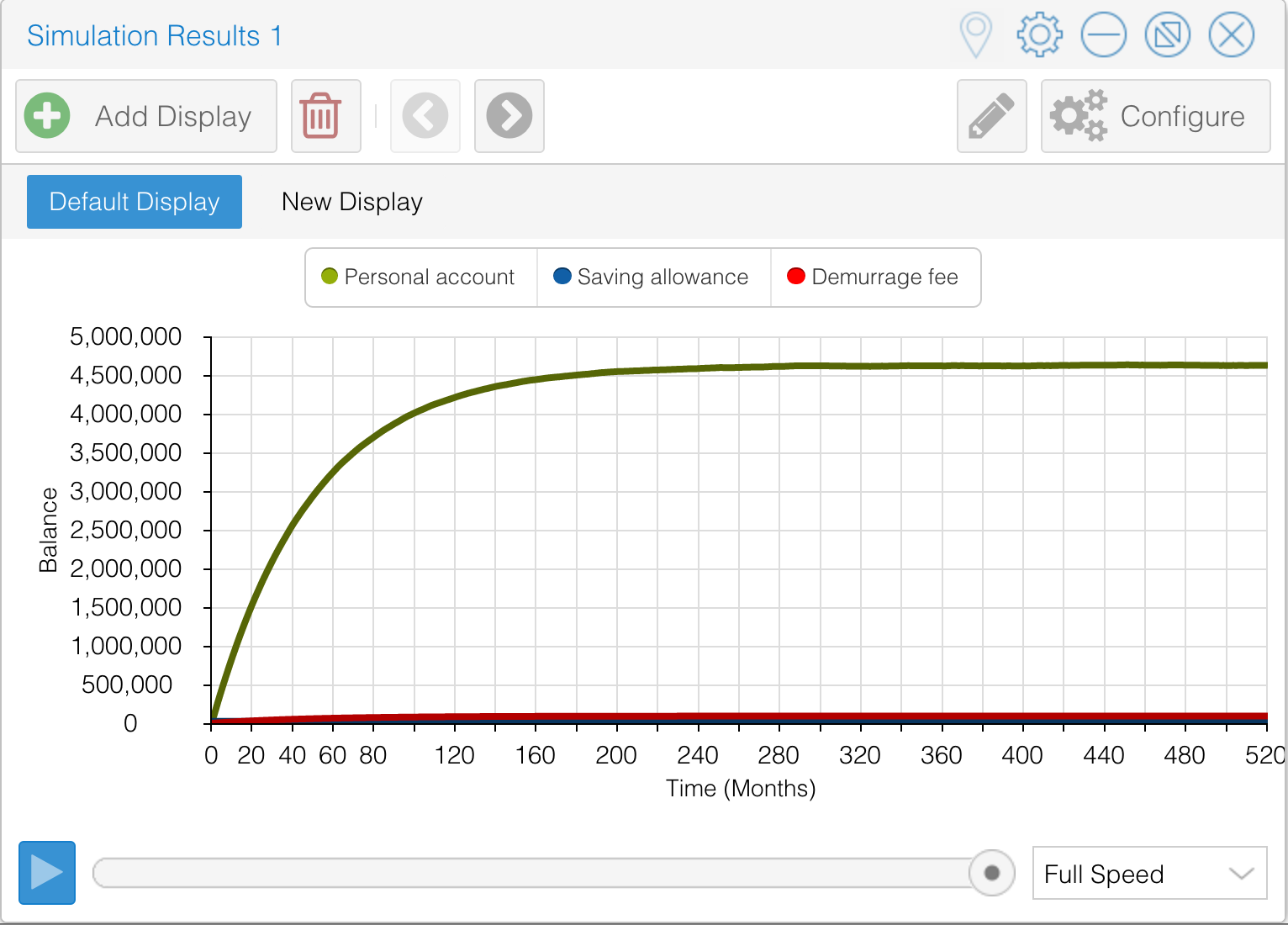

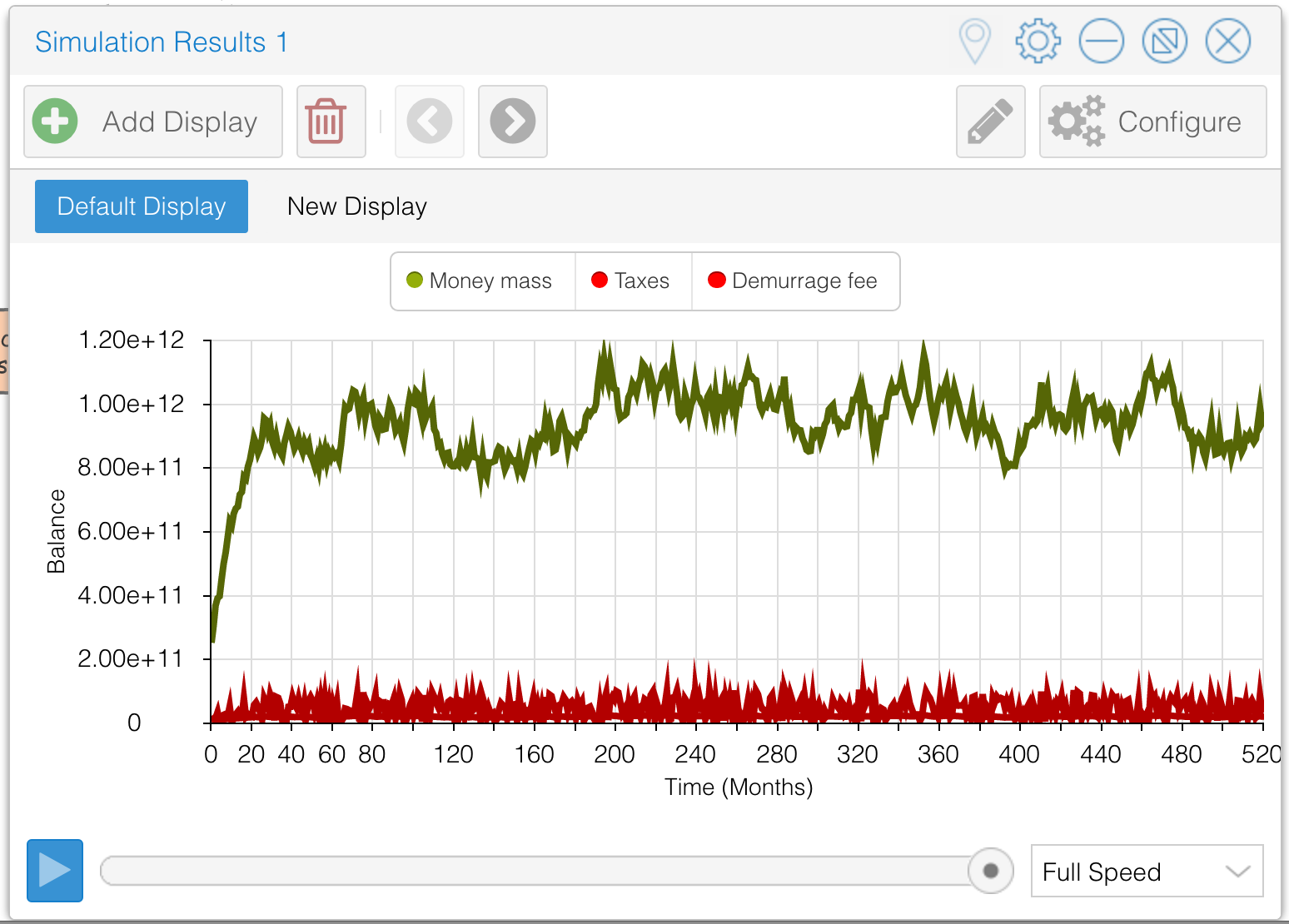

A couple of simple stock and flow models of SuMSy have been created for a single account and the total monetary mass in the SuMSy system. As a comparison, a stock and flow model has also been created which simulates a personal account with a guaranteed income in the current monetary system. Every simulation is run with a guaranteed income of 2,000 SC, a demurrage free amount of 25,000 SC and a demurrage fee of 2%. The latter two only apply to SuMSy simulations. For the personal accounts, a monthly income of 100,000 SC is used in order to model the hoarding incentive of the current system versus SuMSy. Expenses are set at 10,000 SC per month with a variance of 1,500 SC. For the simulation of the current monetary system, an interest rate of 2% is used, which is still easily attainable in the financial markets.

Figure 3 – Account simulation in the current monetary system with 2% interest

An account in the current monetary system with these parameters results in Figure 3 above. With the same parameters in the proposed model, the graph becomes the one shown in Figure 4. As can be clearly observed, the hoarding incentive evaporates as soon as the balance curve flatlines.

Figure 4 – Simulation of account in SuMSy with 2% demurrage

Figure 5 – Simulation of total monetary mass

A simulation of the total monetary mass, with spending on projects for the common good between 2, 000 SC and 7,000 SC per citizen per month and taxes ranging between 0% and 10% per month (calculated on total monetary mass for simplicity), results in the graph in Figure 5. It is clear from this graph that the total monetary mass remains fairly stable over time.

There are several parameters which have an influence on the effects of implementing SuMSy. These are:

Instead of having these parameters being determined by a central authority, we propose that the decision is given to the population. As Nassim Nicholas Taleb describes in his book Antifragile, adding a certain amount of chaos to a system actually makes the system better. Based on this, we have made the assumption that the system can become a learning system that adapts itself to the situation at hand.

Since the parameters must be able to change in order to adapt to a changing society and economy, we propose that everyone who has at least one account in SuMSy can vote for these parameters once a year. We want to avoid annual shocks to the system, which could happen, for example, if everyone decided to double the guaranteed income all at once. To avoid this and similar events, the changes need to be spread out over a period of time.

One easy way to achieve this spread would be to give everyone a window of a month, starting for example on their birthday, in which they can change their preferred parameters. The working parameters of SuMSy are then determined by the median of everyone’s votes.

There has to be a limit as to how much the new parameters can deviate from the previous parameters to avoid shocks to the system. For example, if someone could set the guaranteed income at one trillion SC a month, this would completely destroy the balance. To keep this in check, we propose the following boundaries as an example:

More research is needed to gain a better understanding of the possible fluctuations that could be allowed.

It would be interesting to do research on what the initial set of parameters would be if we could allow the population to determine freely what they think they would have to be, and to simulate how that would play out in a working economy, through an agent based model.

The phrasing would be important though. We would expect a different outcome if people were asked, “What would you like to get as a monthly guaranteed income?” vs “What do you think everyone should get as a monthly guaranteed income?”

As stated previously, we believe that the decision of whether a project is for the common good is something that could be handled by the population. The process of how this would be handled is crucial though, because a badly-designed process could turn out to be disastrous. One necessary component of this process is to open an informative communication channel between the experts and the population at large.

An initial response by many could be that this would be better left to a centralised entity, but we would argue against that. Centralisation of power has a tendency to lead to abuse of power. It could be argued that checks and controls could be put in place to counter this, but then the question arises of who will enforce these checks and controls, and that process often fails, as we can witness today.

Decentralisation of power, however, has an inherently lower chance of being abused. Furthermore, based on the research by Nassim Nicholas Taleb, we believe that it is better that a lot of small things go wrong so the system as a whole can learn and get stronger than if we get black swan events with disastrous outcomes.

Since determining which projects do and don’t get funding has an immediate effect on people’s lives, we have a built-in feedback system. This feedback system and the fact that projects can be started and stopped leave room for failure, without that failure becoming necessarily dramatic. The transition towards handing over full responsibility might have to be done in phases, although we should research this before jumping to conclusions. People just might surprise us.

Contrary to the determination of which projects should get funded or not, we believe that budgeting of those projects should be left to their stakeholders. We believe that a collaborative process between them is possible and should lead to fair budgeting.

The power to assign as much money to a project as is needed also introduces a risk for corruption. In order to protect against that, SuMSy offers complete transparency to these funds. To do that, we earmark every coin that is brought into circulation for a project for the common good, along with all the coins that are allocated to that project from demurrage and taxes.

Every coin for education gets an education tag, for example. These coins can be tracked publicly until they have reached an organisation which has been approved to work on that type of project. This introduces some administration, but it does make tracking down and rooting out corruption very easy and the administration involved would be fairly lightweight.

As with the projects for the common good, we propose that the population should also determine what is to be taxed. Finding a working process for this might even be more challenging than the one to determine the projects for the common good. However, the fact that people can choose where their taxes go, combined with the certainty of a guaranteed income and a sense of control over the monetary system, might eradicate some or maybe even most of the resistance people have towards paying taxes.

A monetary model that works this way affects people’s behaviour through the incentives it creates.

Flowing money

The demurrage fee discourages extreme hoarding of capital. Because of this, money continues to flow, instead of getting ‘stuck’ in large capital hoards. This increases monetary velocity, and thereby, results in an economy which is less prone to a slowdown.

Interest free lending

It becomes interesting to lend out the capital that is subject to a demurrage fee in order to safeguard it against the said demurrage fee and then have it returned interest free in smaller, periodic chunks. This allows people to invest in projects in which they believe and the payback can be guaranteed by the platform up to a point, because there is always the guaranteed income flowing into the accounts of owners of the investment initiative. A well-implemented platform can even automate lending under guaranteed conditions and with explicit permission of the custodian(s) of the account(s).

The outcomes listed here are assumed, and are based on both the incentives the model introduces and research that has been done into human behaviour.

Shift from thinking in capital to thinking in monetary streams

Large, stationary capitals are not compatible with SuMSy. On the other hand, monetary streams are a natural part of it. We assume that this will eventually shift the thinking process from capital to monetary streams. That kind of thinking gives rise to a new way of looking at business models where money is in constant movement. When money flows constantly, the economy is always activated and economic crises could become a thing of the past.

Power shift

Throughout history, those who controlled the creation of money also ended up with the greatest power, according to the research in Debt, the first 5,000 years. The system enables every individual to have a say in what money is brought into circulation for and thereby shifts the power away from centralised institutions towards a decentralised participative model.

Direct action

The fact that the creation of monetary streams for projects for the common good is decided in a participatory way allows people to directly influence concrete action that has an effect on them and society at large.

Free time and mental bandwidth

The book “Scarcity” explains what scarcity does to people’s behaviour. This can be scarcity in money, time, social contact, etc. Concerns about scarcity gain the upper hand and result in short term thinking and tunnel vision. Most importantly, this eats away at mental bandwidth, of which we all only have a limited amount each day. Scarcity in mental bandwidth leads to a hampered ability to reflect and assess true value in one’s life. A guaranteed income tackles the scarcity of money, something that often leads to scarcity in other areas as well. It takes people out of survival mode and frees up time and mental bandwidth for reflection. It shifts people from earning a living to having a life.

Increase in collaboration and sharing

Adam Grant’s ‘Give and Take’ shows that people are more inclined to give than we would think. It’s just that we live in a society where, out of fear of not having enough money, giving, sharing and helping are negatively influenced by the current monetary system. Taking away the fear of not having enough money would work towards making people more collaborative and supportive towards each other. There is scientific backing for this. Research has shown that human nature is basically good.

Emergence of new, more sustainable business models

Short term capitalisation does not function well in SuMSy, because the capital would have to be moved very quickly again in order to not lose large parts of it to the demurrage fee. Investments in long term, sustainable projects with a lower but regular return on investment become far more interesting. This stimulates sustainable long term investments, which are highly needed, yet discouraged in our current monetary system because short term capitalisation can bring in much more profit.

From ownership to service

Ownership of goods usually requires money at the moment of purchase. The purchaser might borrow this money to make the purchase, thereby transforming outgoing money into an outgoing monetary stream. The seller on the other hand receives potentially large sums of money, which is not the ideal situation. The performance economy, which is a model created by Thomas Rau would fare much better and would create an incentive to produce long lasting, energy efficient, repairable and recyclable products.

Increasing job market flexibility

Since taxes on labour become obsolete (as governance projects are no longer solely dependent on taxes to be fully funded), the entire administration surrounding it can be ditched. This opens the door to a vastly more flexible job market. People can now choose to have several part-time jobs, if that’s what they want, without going through all of the paperwork. Only the contracts between the employer and the employee remain, together with the legislation which makes them enforceable. An on-demand job market can flourish without the administrative hassle. Restaurants, coffee bars and pubs could even ask their customers to jump in to help out during busy hours.

A self learning, self steering society

SuMSy has several feedback loops built into it. The parameters are determined by the users of SuMSy, so that they can steer these parameters based on the effect that they have on their current lives. Projects for the common good can be started and stopped. Taxes can be installed and taken away. All these actions have a direct effect on people’s lives and are therefore feedback loops. If this is combined with well-designed decision making processes to determine these things and with open and clear communication channels between citizens and experts, we can expect to get more involvement from citizens in running the society in which they live.

SuMSy is scalable. It can be implemented either in communities, on a local level in towns and cities, or in countries and the entire world economy. The model even supports exchange rates between implementations if needed. In order to exchange X A$ into B$ the following is done: The exchange rate is determined based on the following formula:

ABase and BBase are the balances on the accounts in the SC currencies where the demurrage fee becomes equal to the guaranteed income when the full demurrage free amount is allocated to the account. This is dependent on the demurrage free amount, the guaranteed income and the demurrage fee. This has no profound effect on the total monetary mass since the demurrage fee will take care of excess money being created. Exchanges going the other way, from currency B to currency A, also help to cancel out inflationary effects.

The model can be extended to create an incentive for sustainable consumption. However, it would depend on the feasibility of implementing a sustainability rating which is accepted across the entire user base of a SuMSy implementation. Imagine that we have such a rating system which has the rating scale is 0 to 100, 0 being non- sustainable, 100 being completely sustainable.

Since SuMSy is a digital monetary system, spending habits can be tracked (ensuring that privacy is protected), and therefore, sustainable spending can be rewarded. This could be done through a bonus to the guaranteed income. In order to achieve this, we calculate the average sustainability rating of someone’s spending over the period between 2 guaranteed income deposits. Based on that, we give them a maximum bonus of, for example, 10% on their guaranteed income. Imagine if someone’s average rating over the period is 40, then they get 40% of the 10% bonus, i.e., a 4% bonus on their guaranteed income.

SuMSy opens up room for diversity. Since governance is no longer dependent on taxes for budgeting, a more relaxed policy towards other currencies can be adapted. A plethora of local and/or special purpose currencies could be introduced alongside SuMSy in order to solve specific economic, social and environmental challenges. The only thing to guard against is that these currencies are not used to avoid the taxes on unsustainable behaviour.

SuMSy aims to be a viable replacement for the current dominant currency system. Switching over from one day to the next, although theoretically possible, is not likely. Therefore, a transition period is needed in order for the switch to be executed in a nondestructive way.

Cooperation of governance would be the fastest way to implement a transition. As soon as governance accepts this system, starts paying jobs with SuMSy Money and eliminates taxes as a sole source for their income, everyone will automatically make the transition. Governance support, although helpful, is not a necessity to make the transition though.

One transitioning method is described here but others might be implemented differently.

Let’s assume that we envision the following if people would be willing to commit for 100% in SuMSy:

SuMSy can be introduced incrementally in the following way. Give everyone a free personal account with 5% of the starting capital, being 250 SC in this case. This capital sits in the account until it has been activated.

Once people activate their accounts, they sign in at a certain commitment level. The starting commitment level is 5%. The commitment level determines the maximum percentage of the price people are allowed to pay in SC, and the minimum percentage they are required to accept in SC.

The exact percentages that are used depend on the other party. Someone who has committed for 5% can only pay 5% of the price of an item regardless of how much the seller wants to accept. The other way around, a seller who commits for 5% will only need to accept 5% of the price in SC, regardless of the commitment level of the buyer. The following three paragraphs will explain what happens once an account has been activated.

The activated account, including the commitment level becomes publicly visible in a ledger. A guaranteed income equal to 5% of the target 100% guaranteed income, being 100 SC/month is gained and a demurrage free amount of 5% of the 100% savings limit, which is 1,250 SC, is implemented. The account holder can now use the available money to pay up to his commitment level (currently 5%) of the price of services/goods purchased from others who accept it.

The account holder commits to accepting 5% of the price of his/her own offered services or goods in SuMSy Money and 95% in regular money. This ensures reciprocity, and at the same time, expands the available offer to be purchased with SuMSy Money. The vote of the account holder to change the parameters of the system has the same weight as their commitment level.

The account is now activated and can be used freely with others in SuMSy. All active accounts, although not their balances, are visible in the SuMSy network, together with their commitment level.

The account holder can opt to increase his or her commitment to SuMSy at any time, by increasing the percentage that is being accepted for their products or services. At this point, the following happens:

Extra start capital is deposited onto the account. This amount is a percentage of the 100% start capital. The percentage is equal to the new percentage – the old percentage of commitment. The guaranteed income is raised to the new percentage. The demurrage free amount is raised to the new percentage. The percentage that can be spent, with people who are willing to accept that percentage, is raised to the new limit.

For example, if someone decides to raise their commitment from 5% to 20%: Guaranteed income rises to 400 SC/month, the demurrage free amount is raised to 5,000 SC and the start capital is raised with 750 SC (20% – 5% = 15% of 5000)

Due to the built-in transparency and reciprocity, abuse of the account (spending without willingness to receive) is excluded. The public ledger shows a list of available goods and services purchasable with SuMSy Money, including the maximum percentage of the price that can be paid with it.

In order to have a successful start, it is important to assess which initial services or goods would be sufficient to entice people to participate in SuMSy. Being first is practically risk free because the people spending the currency will automatically accept an equal percentage. It is also possible that people commit to SuMSy under certain conditions.

Someone might say that they are interested in participating in SuMSy, but only if they can purchase food, beer and web services, for example. That way, they could commit without actually activating their account until these conditions are met. They could even have their initial commitment level be dependent on the commitment level of the providers of these goods or services.

One challenge is in allowing employees into the system. If too many people who do not directly offer goods or services are introduced to SuMSy this may cause problems. One solution for this is to only allow goods and service providers to enter SuMSy on their own accord. Once they have committed to SuMSy their employees are also allowed to commit to it but only to the same level as their employers. This setup could introduce internal pressure from employees to get their employers to make a commitment, thereby enriching SuMSy.

Due to its design, the currency is digital. However, it should not be implemented in a centralised fashion. In order for the model to work fully, a distributed implementation is necessary. The dominating technology for that is currently the blockchain.

There are, however, a couple of negative issues with this technology. Transaction speeds slow down when transaction volumes increase, as a tremendous amount of processing power, and subsequently energy, is required to run its security algorithm and once a currency has been launched, it can no longer be changed.

The first two issues stand in the way of scalability. The energy requirement opposes the sustainability goal of the model. The unchangeability creates a problem in the likely case when tweaks need to be done in order to optimise the model. In the case of Ethereum, this has resulted in four forks to date, something that is not desirable should the system run a world economy.

Therefore, the technology requirements for a successful implementation of this model are defined as follows:

Possible contenders could be the frameworks proposed by MetaCurrency, HashGraph or HoloChain.

The simple design of SuMSy would, by itself, already create a tremendous shift in behaviour and societal structures. This comes at no cost apart from the implementation and running of the digital platform.

Compared to the efforts required by governments to achieve these changes, it is virtually free. However, decisions still need to be made on the choice of monetary streams to create to support projects for the common good and what should be taxed. The crux here is to determine what can be considered as a ‘project for the common good’ and what is considered to be ‘behaviour damaging society and/or the environment’.

There are some things which we can already put on the permanent ‘projects for the common good’ (e.g., education, health care, free public transport, environmental care) and the ‘damaging to society and/or environment’ (e.g., pollution, production of non-repairable products, production of non-recyclable products, etc.) lists, yet others would have to be decided on. To aid this decision, we have a couple of suggestions which could be used as inspiration, although these are up for discussion. The selection of these models and structures is strongly linked to, yet beyond, the scope of this paper.

Apart from having to build the distributed platform on which SuMSy runs, the following factors would contribute to a successful adoption:

There is a new and updated document available. A modified version of it will replace this page in the near future.

Stef Kuypers has a vast experience in IT, creative thinking, improvisation and business interventions. He self-studied economics, monetary systems, complexity theory and sociology through reading online research articles on the subjects and engaging with progressive thinkers.

He became interested in monetary systems after discovering that the biggest hurdle to solving our climate change problem is actually our monetary system. Because of this, he started wondering whether we could create a monetary system which would create more sustainable economic and social behaviour and support the wellbeing of all people. That kind of thinking eventually led to the creation of the Sustainable Money System.

Do you know a thing or two about money systems? Do you want to contribute to the Happonomy? Then feel free to join our scientific research! Reach out to us and let’s make our world a better place.

A lot of the references mentioned below are not directly mentioned in the text above but all have been a source of inspiration which eventually led to the creation of SuMSy and serve as support for many of the claims made.

Books

Websites

Specific articles and videos

Supportive articles These are some articles written by the author himself which give an insight into the reasons for this model.

Model simulations

Mollit duis Lorem amet veniam minim ad.Voluptate commodo labore aliqua quis esse aliqua.Veniam tempor elit velit non.