object(WP_Query)#11046 (63) {

["query"]=>

array(2) {

["tag"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["post_type"]=>

array(2) {

[0]=>

string(12) "tribe_events"

[1]=>

string(4) "post"

}

}

["query_vars"]=>

array(68) {

["tag"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["lang"]=>

string(2) "en"

["error"]=>

string(0) ""

["m"]=>

string(0) ""

["p"]=>

int(0)

["post_parent"]=>

string(0) ""

["subpost"]=>

string(0) ""

["subpost_id"]=>

string(0) ""

["attachment"]=>

string(0) ""

["attachment_id"]=>

int(0)

["name"]=>

string(0) ""

["pagename"]=>

string(0) ""

["page_id"]=>

int(0)

["second"]=>

string(0) ""

["minute"]=>

string(0) ""

["hour"]=>

string(0) ""

["day"]=>

int(0)

["monthnum"]=>

int(0)

["year"]=>

int(0)

["w"]=>

int(0)

["category_name"]=>

string(0) ""

["cat"]=>

string(0) ""

["tag_id"]=>

int(83)

["author"]=>

string(0) ""

["author_name"]=>

string(0) ""

["feed"]=>

string(0) ""

["tb"]=>

string(0) ""

["paged"]=>

int(0)

["meta_key"]=>

string(0) ""

["meta_value"]=>

string(0) ""

["preview"]=>

string(0) ""

["s"]=>

string(0) ""

["sentence"]=>

string(0) ""

["title"]=>

string(0) ""

["fields"]=>

string(0) ""

["menu_order"]=>

string(0) ""

["embed"]=>

string(0) ""

["category__in"]=>

array(0) {

}

["category__not_in"]=>

array(0) {

}

["category__and"]=>

array(0) {

}

["post__in"]=>

array(0) {

}

["post__not_in"]=>

array(0) {

}

["post_name__in"]=>

array(0) {

}

["tag__in"]=>

array(0) {

}

["tag__not_in"]=>

array(0) {

}

["tag__and"]=>

array(0) {

}

["tag_slug__in"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["tag_slug__and"]=>

array(0) {

}

["post_parent__in"]=>

array(0) {

}

["post_parent__not_in"]=>

array(0) {

}

["author__in"]=>

array(0) {

}

["author__not_in"]=>

array(0) {

}

["search_columns"]=>

array(0) {

}

["post_type"]=>

array(2) {

[0]=>

string(12) "tribe_events"

[1]=>

string(4) "post"

}

["update_post_term_cache"]=>

bool(true)

["ignore_sticky_posts"]=>

bool(false)

["suppress_filters"]=>

bool(false)

["cache_results"]=>

bool(true)

["update_menu_item_cache"]=>

bool(false)

["lazy_load_term_meta"]=>

bool(true)

["update_post_meta_cache"]=>

bool(true)

["posts_per_page"]=>

int(9)

["nopaging"]=>

bool(false)

["comments_per_page"]=>

string(2) "50"

["no_found_rows"]=>

bool(false)

["taxonomy"]=>

string(8) "language"

["term"]=>

string(2) "en"

["order"]=>

string(4) "DESC"

}

["tax_query"]=>

object(WP_Tax_Query)#13578 (6) {

["queries"]=>

array(2) {

[0]=>

array(5) {

["taxonomy"]=>

string(8) "language"

["terms"]=>

array(1) {

[0]=>

string(2) "en"

}

["field"]=>

string(4) "slug"

["operator"]=>

string(2) "IN"

["include_children"]=>

bool(true)

}

[1]=>

array(5) {

["taxonomy"]=>

string(8) "post_tag"

["terms"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["field"]=>

string(4) "slug"

["operator"]=>

string(2) "IN"

["include_children"]=>

bool(true)

}

}

["relation"]=>

string(3) "AND"

["table_aliases":protected]=>

array(2) {

[0]=>

string(21) "hy_term_relationships"

[1]=>

string(3) "tt1"

}

["queried_terms"]=>

array(1) {

["post_tag"]=>

array(2) {

["terms"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["field"]=>

string(4) "slug"

}

}

["primary_table"]=>

string(8) "hy_posts"

["primary_id_column"]=>

string(2) "ID"

}

["meta_query"]=>

object(WP_Meta_Query)#13581 (9) {

["queries"]=>

array(0) {

}

["relation"]=>

NULL

["meta_table"]=>

NULL

["meta_id_column"]=>

NULL

["primary_table"]=>

NULL

["primary_id_column"]=>

NULL

["table_aliases":protected]=>

array(0) {

}

["clauses":protected]=>

array(0) {

}

["has_or_relation":protected]=>

bool(false)

}

["date_query"]=>

bool(false)

["queried_object"]=>

object(WP_Term)#13607 (10) {

["term_id"]=>

int(83)

["name"]=>

string(38) "feel at ease|financial security|policy"

["slug"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["term_group"]=>

int(0)

["term_taxonomy_id"]=>

int(83)

["taxonomy"]=>

string(8) "post_tag"

["description"]=>

string(0) ""

["parent"]=>

int(0)

["count"]=>

int(17)

["filter"]=>

string(3) "raw"

}

["queried_object_id"]=>

int(83)

["request"]=>

string(1095) "SELECT SQL_CALC_FOUND_ROWS hy_posts.ID

FROM hy_posts LEFT JOIN hy_term_relationships ON (hy_posts.ID = hy_term_relationships.object_id) LEFT JOIN hy_term_relationships AS tt1 ON (hy_posts.ID = tt1.object_id)

WHERE 1=1 AND (

hy_term_relationships.term_taxonomy_id IN (2)

AND

tt1.term_taxonomy_id IN (83)

) AND ((hy_posts.post_type = 'tribe_events' AND (hy_posts.post_status = 'publish' OR hy_posts.post_status = 'acf-disabled' OR hy_posts.post_status = 'tribe-ea-success' OR hy_posts.post_status = 'tribe-ea-failed' OR hy_posts.post_status = 'tribe-ea-schedule' OR hy_posts.post_status = 'tribe-ea-pending' OR hy_posts.post_status = 'tribe-ea-draft')) OR (hy_posts.post_type = 'post' AND (hy_posts.post_status = 'publish' OR hy_posts.post_status = 'acf-disabled' OR hy_posts.post_status = 'tribe-ea-success' OR hy_posts.post_status = 'tribe-ea-failed' OR hy_posts.post_status = 'tribe-ea-schedule' OR hy_posts.post_status = 'tribe-ea-pending' OR hy_posts.post_status = 'tribe-ea-draft')))

GROUP BY hy_posts.ID

ORDER BY hy_posts.post_date DESC

LIMIT 0, 9"

["posts"]=>

&array(9) {

[0]=>

object(WP_Post)#13577 (24) {

["ID"]=>

int(2477)

["post_author"]=>

string(3) "340"

["post_date"]=>

string(19) "2019-09-20 11:43:11"

["post_date_gmt"]=>

string(19) "2019-09-20 09:43:11"

["post_content"]=>

string(2952) "

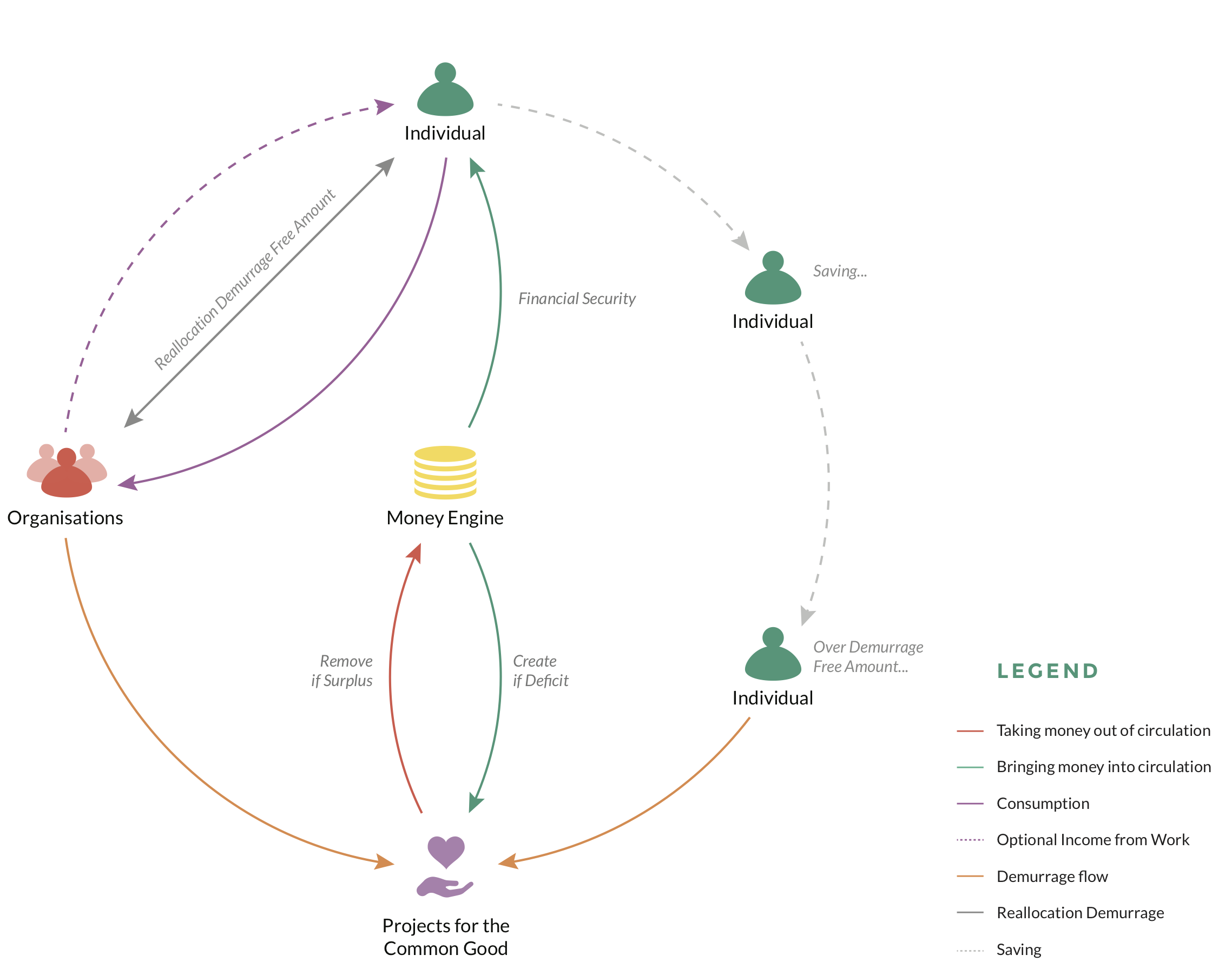

When people are introduced to the Sustainable Money System (or SuMSy), an alternative monetary system that we have developed, they often react by saying that it’s nice, but they don't think that it's feasible.

As a matter of fact, its implementation has already started, at the European Central Bank (ECB) no less! Admittedly, their implementation is currently only for banks and it’s only a partial implementation, but this is just the beginning.

Here's what is happening:

The ECB announced that they will restart injecting money at a rate of 20 billion euros per month. They can do this by printing money, debt free, to buy bonds from banks. These bonds have been printed by governments and are bought by commercial banks, either directly from their government or from private investors who have bought them from governments. These bonds are essentially created out of thin air and the banks trade them for money, which is also created out of thin air, for a profit of course. This profit generates a sort of guaranteed income for the banks, which is very comparable to the guaranteed income you’d get with SuMSy. The main difference is that you don't need to go through the hassle of bonds to get your guaranteed income from SuMSy.

The ECB charges a 0.5% negative interest rate on excess bank reserves, which is the same as the demurrage (also a type of negative interest) charged in SuMSy. This interest is used to pay for the working costs of the ECB at first and the excess is distributed throughout the member states. Let’s consider the ECB, which oversees the monetary system, and the governments, which serve their citizens, as projects for the common good. This is the same structure as in SuMSy. The difference is that these projects for the common good are more concretely defined in SuMSy, so you have a better idea of exactly where the money is going (e.g. education, healthcare, environmental care, etc.) and, when there is not enough money to execute these projects adequately, extra money can be created. Other than that, it’s the same.

The ECB announced that, in order to alleviate the effects of this negative interest (i.e., the demurrage), they will introduce a two-tier system, where the first tier is exempt from the 0.5% demurrage. This is exactly the same as the demurrage-free buffer in SuMSy.

Our thanks go to Mr. Draghi for showing us that SuMSy is not such a crazy idea after all."

["post_title"]=>

string(55) "SuMSy, we're getting there ... with the help of the ECB"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(30) "sumsy-with-the-help-of-the-ecb"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-09-25 16:59:56"

["post_modified_gmt"]=>

string(19) "2019-09-25 14:59:56"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(33) "https://www.happonomy.org/?p=2477"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[1]=>

object(WP_Post)#13540 (24) {

["ID"]=>

int(2286)

["post_author"]=>

string(3) "324"

["post_date"]=>

string(19) "2019-09-13 11:38:41"

["post_date_gmt"]=>

string(19) "2019-09-13 09:38:41"

["post_content"]=>

string(14489) "

Social comparisons of income don’t allow economic growth to improve people’s happiness. Is there a remedy for this?

Little house shrinks to a hut

“A house may be large or small; as long as the neighbouring houses are likewise small, it satisfies all social requirements for a residence. However, let there be a palace next to the little house, and the little house shrinks to a hut.” This quote, which describes the struggle to keep up with the lifestyles of others, dates back to Karl Marx’s Wage Labour and Capital, published in 1849.

Today, the ‘keeping up with the Joneses’ phenomenon is a well-studied subject in social science. The use of representative, cross-national survey data allowed researchers to answer some of the most fundamental questions related to the tendency to look at our neighbours when evaluating our own material status.

What are the roots and consequences of social comparisons of income? How do they affect happiness on an individual level? Furthermore, how do they relate to economic growth which is seen as a determinant of society’s well-being?

More is not enough, but more than others will do

In order to understand the importance of social comparisons for happiness research, it is necessary to refer to the paradox first described by Richard Easterlin, the founding father of happiness economics.

In his seminal 1974 article, Easterlin explained that, even though the average level of happiness is higher in richer countries compared to the poorer countries, GDP growth is not followed by happiness growth. In other words, there is a positive correlation between happiness and income at a given time, although an income increase will not necessarily cause a happiness increase.

Easterlin offered two explanations of this paradox.

The first one is a ‘hedonic adaptation’: as people become accustomed to improving living standards, an income increase can only have a short-term effect on happiness.

The second explanation is ‘social comparison’: as people compare their incomes with others, raising the incomes of all does not increase the happiness of all.

Income comparisons damage happiness

Easterlin’s message was quite far-reaching: social comparisons of income make economic growth unable to increase people’s happiness. His macroeconomic conclusion has been supported by studies on an individual level, which found that the effect of income comparisons on happiness can be twofold: indirect and direct.

The indirect effect of comparisons relates to the fact that they reduce the positive impact of income on happiness. The income of the reference group, i.e. people of similar socio-demographic characteristics, is about as important as the own income for individual happiness. In consequence, if my income increases to the same degree as the income of my neighbour, my happiness remains unaffected: I will be happier only if the increase of my income is greater than the increase in income of my neighbour.

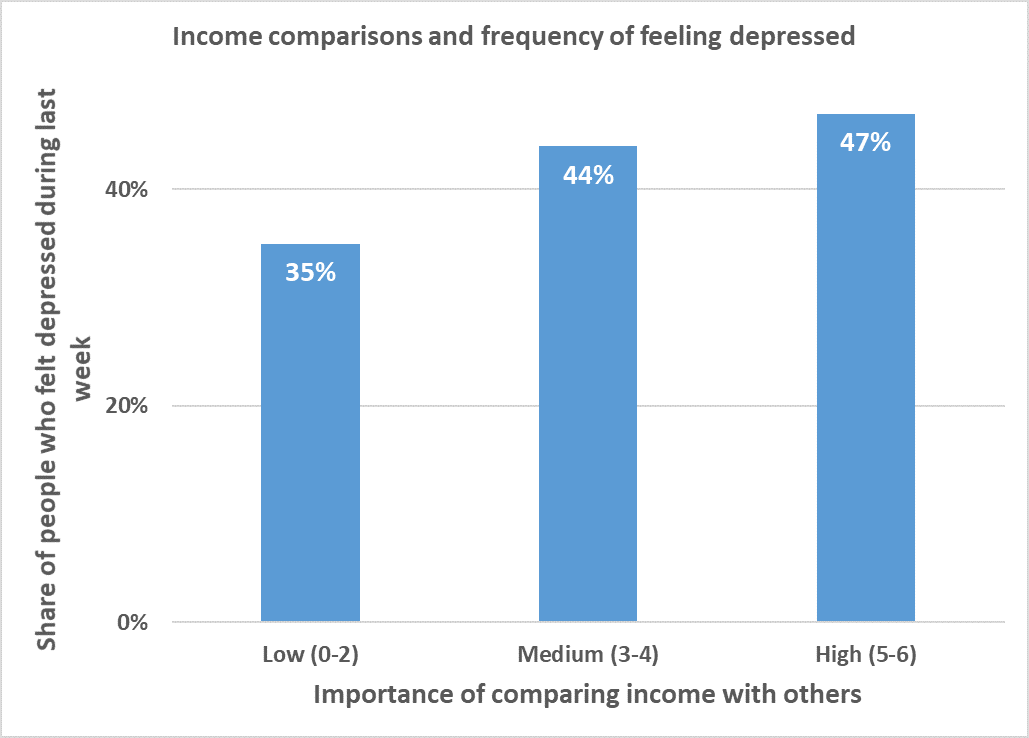

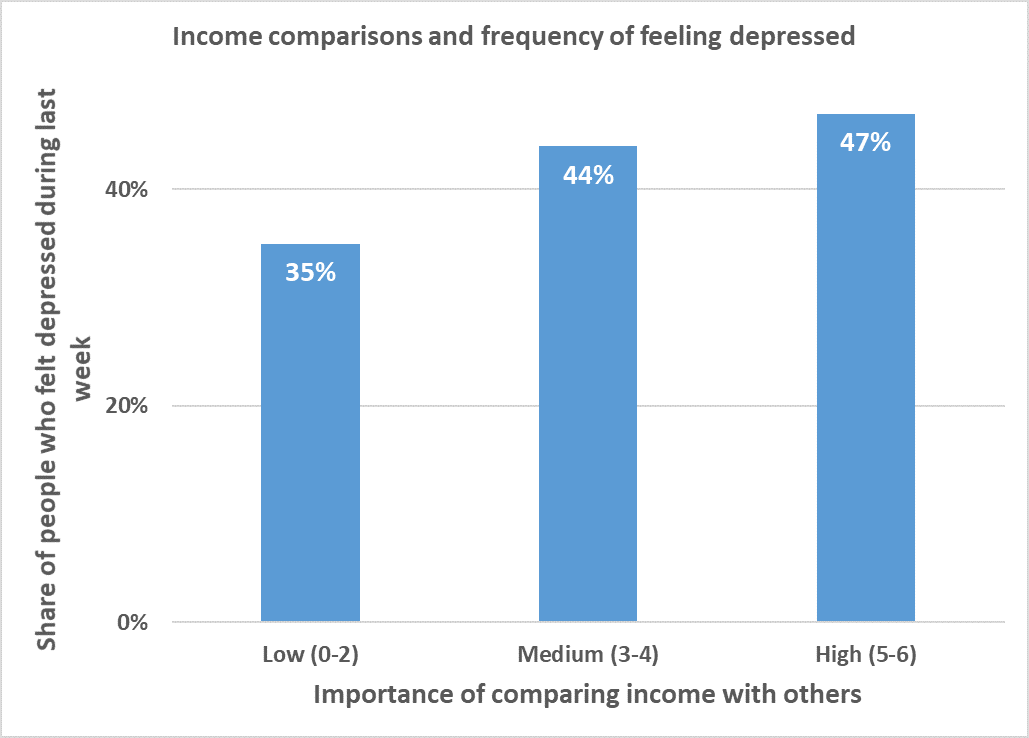

Income comparisons also have a direct effect on happiness: individuals who compare more, are less happy, regardless of their income level. The European Social Survey data shows that individuals who declare high importance to income comparisons are more likely to feel depressed (Figure 1). The same data reveals that ‘keeping up with the Joneses’ is a widespread phenomenon in Europe; income comparisons are considered to be at least somewhat important by three‐quarters of Europeans.

Figure 1. Individuals who declare high importance of income comparisons are more likely to feel depressed. Source: author's elaboration based on European Social Survey, 2006. Sample: 17,368 respondents from 18 European countries.

Wording of questions:

“How important is it for you to compare your income with other people’s incomes? Answers are indicated on the following scale: 0 – Not at all important, 1, 2, 3, 4, 5, 6 – Very important.

“How much of the time during the past week did you feel depressed?” The answers could be indicated on the following scale: 1 – None or almost none of the time, 2 – Some of the time, 3 – Most of the time, 4 – All or almost all of the time. ('People who felt depressed' means people who felt depressed at least 'some of the time'.)

When it comes to the direction of comparisons, colleagues are the most frequently indicated reference group. Income comparisons exist mainly within reference groups of the same gender; however, women are also likely to compare with men, while men do not necessarily compare with women. Importantly, individuals weigh upward comparisons more heavily than downward comparisons, which explains why comparisons to the poor cannot increase happiness – they are outweighed by the comparisons to the rich.

The study of income comparisons has additionally proved to undermine the theory of a rational economic agent, according to which individuals always tend to maximise utility derived from their own income. An experiment performed in Sweden showed that people, when faced with a hypothetical choice, preferred a scenario in which they earn less in absolute terms, but more than others, compared to a scenario in which they earn more in absolute terms, but less than others. Put differently, individuals were ready to renounce part of their income in exchange for a higher position on the income ladder.

Income comparisons can also have a detrimental effect on the work-life balance. A recent study of a representative sample of Flemish workers established that the wish to increase working hours is driven by the perception of one’s income in comparison to that of others, rather than by one’s actual income.

Empirical research on relative income concerns goes beyond socio-economic surveys; neurophysiological evidence suggests that social comparisons affect reward-related brain activity.

Figure 1. Individuals who declare high importance of income comparisons are more likely to feel depressed. Source: author's elaboration based on European Social Survey, 2006. Sample: 17,368 respondents from 18 European countries.

Wording of questions:

“How important is it for you to compare your income with other people’s incomes? Answers are indicated on the following scale: 0 – Not at all important, 1, 2, 3, 4, 5, 6 – Very important.

“How much of the time during the past week did you feel depressed?” The answers could be indicated on the following scale: 1 – None or almost none of the time, 2 – Some of the time, 3 – Most of the time, 4 – All or almost all of the time. ('People who felt depressed' means people who felt depressed at least 'some of the time'.)

When it comes to the direction of comparisons, colleagues are the most frequently indicated reference group. Income comparisons exist mainly within reference groups of the same gender; however, women are also likely to compare with men, while men do not necessarily compare with women. Importantly, individuals weigh upward comparisons more heavily than downward comparisons, which explains why comparisons to the poor cannot increase happiness – they are outweighed by the comparisons to the rich.

The study of income comparisons has additionally proved to undermine the theory of a rational economic agent, according to which individuals always tend to maximise utility derived from their own income. An experiment performed in Sweden showed that people, when faced with a hypothetical choice, preferred a scenario in which they earn less in absolute terms, but more than others, compared to a scenario in which they earn more in absolute terms, but less than others. Put differently, individuals were ready to renounce part of their income in exchange for a higher position on the income ladder.

Income comparisons can also have a detrimental effect on the work-life balance. A recent study of a representative sample of Flemish workers established that the wish to increase working hours is driven by the perception of one’s income in comparison to that of others, rather than by one’s actual income.

Empirical research on relative income concerns goes beyond socio-economic surveys; neurophysiological evidence suggests that social comparisons affect reward-related brain activity.

What are the drivers of income comparisons?

Early social comparison theories claimed that an inborn human tendency exists to evaluate oneself, whereas self-evaluation is often performed through comparisons with the abilities and opinions of others. More recent evidence underlined the role of lifestyle in shaping the comparison mechanisms.

In the world of social media, an individual is exposed to an unprecedented amount of personal information, which may intensify comparisons. It has been found that social media users have a higher probability of comparing their achievements with those of others. Additionally, an experiment performed in Denmark showed that a one-week break from using Facebook is enough for an individual to feel less stressed.

Another important factor for determining one’s propensity to keep up with the Joneses are personal values. Income comparisons are strongly associated with materialism, which is defined as an elevated “importance of acquiring money and possessions that convey status.” Due to the lack of causal evidence, though, it is difficult to establish whether it is materialism that drives income comparisons, or, vice versa, that comparisons lead to increased materialism.

A missing element of the puzzle, linked to happiness, materialism and income comparisons, are social relationships. According to one line of research, materialistic individuals tend to objectify others, which results in a lack of cooperative capacity and decreased trust, creating an obstacle for building genuine relationships. In turn, the deteriorated social relationships lead to decreased self-esteem, which, as it happens, can alternatively be acquired through a high income rank. In fact, empirical evidence suggests that people with poor social relationships are more likely to be affected by income comparisons with others.

When does economic growth increase happiness?

Social relationships also play a crucial role when it comes to the macroeconomic approach to income comparisons and their relation to economic growth.

An alternative explanation of the Easterlin paradox claims that whether or not economic growth increases happiness depends on its social costs. If the economy continues to grow at the cost of interpersonal relationships and social cohesion, GDP growth will not increase, yet will only decrease people’s happiness.

An example of such a scenario comes from China, which, in the last two decades, has exhibited dynamic economic growth, but at the same time, has had a significant decrease of average happiness. The diminished happiness of the Chinese was caused by declining social relationships and an increasing importance of income comparisons.

More evidence supporting this view comes from data from over forty countries collected over a period of more than thirty years; economic growth has a positive effect on people’s well-being, only in the presence of increasing social trust and decreasing income inequality.

If we look at the happiest societies in the world – those of the Nordic countries – it turns out that economic growth can increase happiness. The conditions for that to happen are the following: reduced importance of income comparisons, combined with low income inequality and high interpersonal trust."

["post_title"]=>

string(83) "Don’t keep up with the Joneses! Happiness, income comparisons and economic growth"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(48) "happiness-income-comparisons-and-economic-growth"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-09-16 09:23:44"

["post_modified_gmt"]=>

string(19) "2019-09-16 07:23:44"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(33) "https://www.happonomy.org/?p=2286"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[2]=>

object(WP_Post)#13575 (24) {

["ID"]=>

int(2214)

["post_author"]=>

string(3) "340"

["post_date"]=>

string(19) "2019-07-22 12:00:54"

["post_date_gmt"]=>

string(19) "2019-07-22 12:00:54"

["post_content"]=>

string(25448) "

Since it was announced on June 18th, Facebook’s Libra coin has attracted a lot of attention. I haven’t read many of the comments about it, and decided to first read the white paper myself, in order to get a somewhat unbiased idea about it. I say ‘somewhat unbiased’ because I have been working in the field of monetary systems for too long now to avoid all biases. The big question is: “What value does the Libra bring to its myriad of stakeholders?”

What is Libra?

For those who have missed all the hype, Libra is a new cryptocurrency, as announced by Facebook. Indeed, Facebook will not govern it all by themselves, but is setting up a non-profit organisation, the ‘Libra Association’, together with representatives from organisations such as PayPal, Visa, Mastercard and others, which are all listed in the white paper.

Libra coins can be obtained by buying them from authorised resellers, which I shall refer to as ‘resellers’ for the rest of this article. These resellers have to buy the coins from the Libra Association. The act of buying the Libra coins from the Libra Association results in the creation (minting) of the Libra coins. Exchanging Libra coins back into regular currencies also goes through these resellers. The resellers on their part can sell coins back to the Libra Association if they wish, thereby destroying (burning) them.

Once the coins are brought into circulation through the resellers, they can be used for trade with organisations and businesses who are willing to accept the Libra as currency. They might also be used for speculation, which is what mainly happened with Bitcoin.

Setting trust issues with a company like Facebook aside, a first impression of the white paper comes across as fairly positive. The claim that it would save a lot of people from loan sharks by giving them easy access to a sort of bank account is very likely to be achievable. However, that depends on how eager Libra resellers are to extend cheap loans to poor people in developing countries. There is no guarantee whatsoever that the classical loan sharks would not be replaced by Libra loan sharks. However, because competition on those markets would cross borders, that problem might get solved by itself.

The fact that the technology underpinning the Libra coin is made open source is very good news. That way, the open source community can learn from the advances made by the Libra blockchain technology and can either build on it or apply it to other projects. It is bound to attract a lot of attention from developers, which can only be interpreted as good news for the crypto world at large. Of course, any contributions to the Libra framework by the open source community will also benefit the core founders of the Libra coin.

Value stability - a partially unachievable promise

Things become more complicated when it comes to the acclaimed “value stability” of the Libra coin. The white paper claims that the exchange rate of the coin will remain stable thanks to the backing of low risk financial assets. These financial assets include bank deposits and government securities in currencies from stable and reputable central banks, amongst others. From my perspective, this “value stability” claim cannot be upheld, at least not for everyone.

“Because the reserve will not be actively managed, any appreciation or depreciation in the value of the Libra will come solely as a result of FX market movements.”

The above is a literal quote from the Libra reserve paper. Add to that the fact that the Libra is not pegged to any currency in its basket and you get the situation where its trade value is fully dependant on market forces which, as we all know, can be very unpredictable.

The paper on the Libra reserve is full of good intentions to protect consumers from currency volatility. However, no concrete regulations are mentioned. Pegging the Libra to the average or median of the currencies in the basket would be, for example, a concrete protection, but it is literally stated that the Libra Association does not determine monetary policy, thereby leaving everything to the resellers.

These resellers are partially protected against losses because they will always get a minimum price for their Libra from the Libra Association. However, this is not the case for the users of the Libra since for them the exchange rate is set by the market. Furthermore, that exchange rate can either be a lot higher or a lot lower than the exchange rate the resellers obtain for it, depending on demand and the profit structures of the resellers.

The claim that a ‘bank run’, a situation where everyone wants to get rid of their Libra as fast as possible to minimise losses, can never happen is therefore only technically true. The resellers are guaranteed that every Libra they hold is backed by the Libra Association, which plays the role of the Libra Central Bank.

However, the resellers sell their Libra at market value, which will probably be higher than what they pay for it themselves, and can buy them back in at a lower rate than what they sell them for. If the price were to plummet, resellers have the liberty to protect themselves from losses by paying far less for a Libra than what they can get from the Libra Association. This could trigger a ‘bank run’ on the resellers.

This means that the claim of full backing by the reserve only counts for the resellers, and not for the users. The only way to protect against that would be to set maximum and minimum exchange rates for resellers close to the value of the reserve divided by the amount of Libra coins in circulation. However, that would mean the value of the Libra needs to be pegged to the value of the reserve and that’s setting a monetary policy from which the Libra association explicitly refrains.

Libra and currency regulations

Regular currency exchange is supervised under the Forex market regulations. It isn’t mentioned anywhere that the Libra currency exchange falls under these same regulations, thereby limiting regulations to what the Libra Association and the authorised resellers manage to agree on. This could be problematic. The Libra Association is set up as non-profit, but I would be very surprised if the authorised resellers would not be for-profit organisations, which will most likely try to keep regulation as far away from maximising profits as possible.

The Libra Investment Token

Let me introduce you to the Libra Investment Token. It is only mentioned once in the document about the reserve and the Libra Association document elaborates on it in more detail.

This is a token, and, in essence, a second coin. Investors can acquire these tokens by investing a minimum of ten million dollars. In the initial phase, up until the Libra is officially launched, this makes them a founding member.

Investment tokens will also be sold at a later time when additional funding is needed. This token then entitles the holder to receive dividends from the reserve fund. These dividends are gained from the interest that is generated by investing the money in the reserve fund. The interest is first used to pay for the costs of running the association, the Libra currency system and to invest in further development. The rest is partially paid out as dividends to those holding investment tokens.

At first sight, one might think that these dividends will be small because the investments are low risk and are thus likely to have low yields. However, you have to keep in mind that the goal is to turn the Libra into a world currency, which means that scale starts to play a significant role should they succeed.

The supply of these tokens is limited. Initially they are only handed out to the initial investors and will only be issued afterwards if additional funding is required.

If the Libra successfully turns into an accepted world currency, then the holders of these investment tokens stand to gain huge profits due to the size of the reserve. This would mean that the non-profit character of the Libra Association is just a nice facade for a money making machine that mainly benefits the for-profit organisations that started it.

Power structure of the Libra Association

The Libra Association consists of two power entities (the council and the association board), an executive entity (the association executive entity) and an advisory entity (the social impact advisory board).

The council holds most of the power, including overruling decisions taken by the association board. The members of the council coordinate the technical roadmap of the system, in collaboration with the open source community; they manage the reserve, allocate funds and elect and remove members of the association board. The association board plays the role of an oversight body. More details on the roles can be found in the document of the Libra Association.

The members of the council initially include only the founding members. They have each pledged a minimum of ten million dollars to the reserve in exchange for investment tokens.

These founding members are also the only members who validate transactions on the blockchain when the Libra is brought to market. Entities that validate transactions are called validator nodes. Initially only founding members act as validator nodes but a transition path is described in which other entities can also serve as validator nodes at a later stage. The key is the financial stake. The financial stake in the Libra is initially only determined by the amount of investment tokens one holds. At a later date, holding a sufficient amount of Libra will also count towards this financial stake.

Voting power is also determined by the financial stake one holds in the Libra. Every investment of ten million dollars gains you one vote.

The number of votes is capped in order to limit power concentration. For founding members, i.e., those holding sufficient investment tokens, this cap is set to one percent of the votes or one vote, whichever is greater. If a founding member were to hold more votes than the cap allows, the excess voting power has to be given to the Libra Association board, which may delegate the votes to other entities under conditions listed in the Libra Association document. These votes can be given to entities which do not meet the ten million dollars investment requirement.

It is not quite clear from the document whether investors who hold a sufficient amount of investment tokens, but do not act as a validator node, also hold voting power. Reading between the lines, I assume that one needs to be a validator node in order to have voting power, although I’m not totally sure of this.

For those not holding investment tokens, voting power can only be acquired by acting as a validator node, and either holding an adequate financial stake with the custody of Libras, once these start counting towards the financial stake, or by being lucky enough to acquire excess votes through delegation by the Libra Association board.

The number of active validator nodes is limited, and thereby the size of the council is limited too. It is the council itself which decides on this limit, and if the number of active validator nodes should exceed this limit, the member with the least number of votes is removed. In case of a tie, the member with the shortest continuous membership is removed.

Voting is carried out by either a regular majority or a super majority, consisting of at least two thirds of the votes. A super majority is required for:

- changes in the reserve management policy;

- removing a founding member which does not comply with the eligibility criteria;

- making changes to the Libra guiding principles.

It takes some time to get your head around the text presented in the Libra Association document, but the power structure that has been setup gives a lot of leeway for power games, mainly played by the more affluent players.

Voting power for social impact organisations which cannot cough up the required ten million dollars’ entry fee is dependent on the goodwill of the association board to be handed surplus voting power.

This board is elected by those holding the lion's share of power. The limit on active validator nodes, along with the procedure for removal of surplus validator nodes, ensures that those who have invested the most, and have been there the longest, will hold on to their seats of power. In essence, the message is, “Trust us; we’re the good guys,” although there is nothing that can be done if that promise proves to be false.

The Libra Coin users

What about the users of the Libra coin? They are crucial for the success of the currency and they will be the main source of funding for the reserve, and thus also for the profits made from that reserve by those that hold investment tokens. However, users hold no power unless they are able to invest sufficiently in Libra.

The Libra is a non-interest bearing currency which means that users forfeit all interest they could have gained on their normal currency. This is unless, of course, someone would be willing to pay an interest on Libra coin accounts, yet if someone would be willing to do that, you can bet that they will be making a far larger profit than they are paying out.

Current interest rates are virtually non-existent, except for those sitting on a lot of money. However, you have to keep in mind that the non-interest bearing Libra is backed by interest bearing financial assets.

Indeed, that interest, which is more than the average Joe can receive on a savings account, is not going into the pockets of the users. It is stated literally in the document of the reserve that users do not receive a return from the reserve.

If Libra truly wants to help people to stabilise their finances then they could have distributed half of the dividends amongst its users, even in Libra, and thus implement a basic income, yet they categorically chose not to do that. This turns users into assets for the investors of the Libra and they bear the brunt of the risk.

Political power impacted

There is also the question of what would happen when the Libra becomes the most used currency in a country where there are currency problems, such as Turkey, for example. The exchange rate of the Turkish Lira has been on a downwards slope for years, leading to high inflation. What if the Turks dumped their Lira in exchange for Libra en masse? This could crash the value of the Lira even further and could have potentially disastrous effects on the banking system of the country. How would that affect the political independence of that country? What would it do to the local economy? One of the goals, as stated in the white paper, is the following:

“We believe that global, open, instant, and low-cost movement of money will create immense economic opportunity and more commerce across the world.”

This implies more international consumption, which could mean a boon for the investor’s international trade balances, but it could be disastrous for local trade. Unless local merchants also switch to the Libra, further damaging the value of the national currency. In that event, what about taxes? Would the Turkish government be forced to accept taxes in Libra or would the Turkish Lira mainly be used for taxes and will the Libra be used for all other purposes? I’m not going to delve into this further, but I thought that it at least needed to be mentioned in a critical article on the Libra.

Conclusion

Although there are a lot of great promises that are advertised by Facebook and the other founding members of the Libra, I’m personally very sceptical about it. Other than the promises, I see nothing that truly guarantees protection of Libra coin users against exploitation, except maybe the fact that exploiting the users is bad for business for the members of the Libra Association. This is because they stand to make a lot of profit from this initiative should they succeed in their goal of making the Libra into an accepted world currency.

I do see a lot of safeguards for the early investors and the resellers though. In the end, should the initiative fail, the losses are minimal. The investors would have access to the developed technology on which they can build other projects. They would have gained a tremendous insight into monetary policy and legislation which can also be used for future projects. The cost of setting up the non-profit organisation is very little and there is virtually no investment in hardware because the initial investors already have the infrastructure needed to set this up. The money that is not used is held in a secure fund which is managed by all the players that put their money into it. Therefore, it is not so hard to imagine that, in the case of utter failure, this fund will be redistributed according to the amount of investment tokens each investor holds.

Should it fail, those who stand to lose the most are the users. There is no guarantee that the resellers will still be willing to buy Libra if their profit margins for doing so fall below certain thresholds. The coins in circulation will then only be useful if the validator nodes, which are run by the initial investors for the foreseeable future, are still up and running. However, there are no guarantees for that and when the risk of validator node shutdown looms it becomes very unlikely that people will still be willing to accept Libra for their goods and services. The open source community could possibly help out there if they set up a parallel structure and offered to exchange Libra to ‘new Libra’. I think it would be a good idea to have that in place from the beginning.

Furthermore, all the Libra which die together with the last validator node would mean extra profits for the founding members because they won’t have to buy them back.

I realise that I’m painting a worst case scenario here and I don’t know how things will evolve. Only time will tell though, and I believe that painting a worst case scenario is necessary because it opens up pathways to improve on what is there and to mitigate the known risks.

Hey Facebook, join the Happonomy

At Happonomy, part of our mission is to help organisations design money so it aligns with those things we find truly valuable in a better way.

So here’s our feedback to the Libra founders: if you are truly interested in creating value for those who have no access to bank accounts and cheap loans, we suggest doing the following:

- Add a dividend of your own design, in Libra, for the users. Pledge to invest at least half of the surplus interest, after subtracting operational costs and structural investments, gained from the reserve to this, thereby implementing a basic income in Libra.

- Put a cap on the dividends which holders of investment tokens can gain and maybe have a look at our Slingshot model for value-driven organisations.

- Change the power structure of the Libra council so that there is a constant rotation with new members, which is also part of our Slingshot design.

- Peg the value of the Libra to the median of the value of the reserve in order to create true value stability for users and not only for resellers.

- Use a method to determine value contribution and build in accountability in order to uphold those values. We have our value canvas which could help you out in determining value.

- For more inspiration, you can also have a look at our own currency design, the Sustainable Money System.

To end on a positive note, maybe the critique published by myself and others could help to shape the final version of the Libra. If not, the developed technology could be useful for the open source community and might one day become the foundation for something that truly has value creation for everyone at its core."

["post_title"]=>

string(27) "Libra coin: a critical view"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(26) "libra-coin-a-critical-view"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 15:39:22"

["post_modified_gmt"]=>

string(19) "2020-05-20 13:39:22"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(33) "https://www.happonomy.org/?p=2214"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[3]=>

object(WP_Post)#13539 (24) {

["ID"]=>

int(2026)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2019-05-23 12:20:12"

["post_date_gmt"]=>

string(19) "2019-05-23 12:20:12"

["post_content"]=>

string(12454) "

In an earlier article, I built a case against the idea of a Universal Basic Income (UBI), even though I’m in favour of the principles and values on which the idea is built. Does this sound paradoxical to you?

The reason is simple though. We can craft a solution to take the best a UBI has to offer (freedom and security), and then combine it with other elements toincrease the quality of our lives even further.

A very important bonus is that it will also reduce the resistance which so many people have against the idea of a UBI, because it will reduce inequality even further and will cost less.

A dynamic happiness income: a pragmatic upgrade of a UBI

What if our society could guarantee that everybody would have sufficient money to live a good life from birth onwards? This would be a dynamic happiness income.

A dynamic happiness income is an income that guarantees to support the quality of our daily lives to the utmost extent. It is rooted in the idea that we can have the basics of our survival covered, and also that we can all live a truly abundant, high-quality life. It also looks into the real needs of every individual.

A dynamic happiness income is more about enabling you to enjoy life in all its dimensions than it is about preventing the struggle of survival. In a sense, it is even more ambitious than a universal basic income.

You may have noticed that the typical characteristics such as equality and universality found in a universal basic income are absent. This is not because they are forgotten; it is because they are not there, and with good reason.

A dynamic happiness income, a pragmatic upgrade in fairness

Fairness is central to our actions, and is something that we can even see in our ancestors, the primates.

Without any doubt, a UBI takes many steps to reduce inequality between people. The good news is that we can have even more of it. If we give everybody the same unconditionally, we reduce inequality. However, we will still be confronted with a situation where inequality will be at a level that we don’t want.

Studies by Dan Ariely, a well-known behavioural economist, show that the differences we considered to be ‘just’ are much smaller than those we are facing now.

The truth is that our system isn’t fair. The reality is that the majority of people need to go to work to pay for the bills just to meet their basic needs. More and more people are subsequently struggling and individual differences are becoming ever bigger.

Assuming that we want a ‘just’ system, we need to adjust the idea of a universal basic income, so that it fits our current reality. Accepting these differences enables us to turn the imminent problems we are facing into an opportunity for a high-quality life, because, unlike what you may think, there has never been more potential to upgrade our world for the better.

How dynamic happiness income differs from universal basic income

To achieve increased fairness, to reduce ‘waste’ and to align more closely with those things that drive our happiness, a dynamic happiness income introduces the following three adjustments to the universal basic income:

- It is not for everybody;

- It is not the same for everybody;

- You cannot spend it freely.

Pragmatic upgrade #1: It is not for everybody

A dynamic happiness income does not make abstraction of the inequalities we have in our societies; it embraces them, even though that tastes like a nasty syrup.

A dynamic happiness income is therefore not for everybody. A dynamic happiness income takes into account your current income level and its source. If you earn a sufficiently high income that is not linked to your time, i.e. a passive income, such as an income from a house rental or financial products, you are not receiving anything or at least not the full amount you would get without that passive income.

Because you already have the means to live a high-quality life without having to work a full-time job, you already have the sense of security and the freedom to choose how you spend your time. Good for you!

That’s fair, right?

Pragmatic upgrade #2 - Personalised, not the same for everybody

As George Orwell said in Culture's consequences: International differences in work-related values. (Vol. 5. sage, 1980), “All societies are unequal, but some are more unequal than others.” That is why we need a system where the income we give to people is dynamic.

The hand we’re dealt with to play in life is different for all of us. You may have married a rich specimen, or maybe you inherited a house. Maybe you live alone, maybe you don’t. Maybe you have an illness or maybe you’re just five years old. All of these things impact the amount you are receiving.

That’s why a dynamic happiness income takes into account our differences and situations throughout our lives.

Taking into account individual differences is essential to achieve a system that maximises the potential for abundance for all of us. When we focus on the real needs a person has and adjust the amount to those needs, this strengthens our sense of fairness, and consequently increases efficiency. We spend money where it is needed and avoid spending where it is not.

Pragmatic upgrade #3 - You cannot spend it freely

Firstly, we cannot create happiness. Happiness comes from within, and the best we can do is to try to maximise the circumstances for happiness. We can only craft the scene for us to have the potential to live a high-quality life.

Therefore, the question is, “How should this scene look?” This is where, as a society, we can choose to set standards. Just as a staff member sets the stage, we can use a dynamic happiness income to support those needs that drive the well-being of people, even if those people do not value them as such.

That is why you cannot spend the dynamic happiness income freely. To be clear, this choice is made to support freedom, rather than curbing it. We can use a dynamic happiness income to drive choices that support the well-being of all of us, making it possible for us all to thrive in our own unique ways.

In case you still find this hard to accept, let me ask you this: “Are you happy that a single person would spend his or her universal basic income on cigarettes and excessive amounts of alcohol, things the person uses to numb insecurity and which destroy their health?

If you think it is more desirable to use this income to give this single person safety, basic comfort, decent food, access to healthcare, even if he or she doesn’t really value these things, then we are on the same page. The only limitation to freedom people should be willing to accept is to those things that science has shown to drive our well-being.

Don’t forget to keep your eye on the prize

Although the idea of a UBI has been discussed for centuries, it is still not here. Don’t let the experiments currently running in The Netherlands and Finland fool you. They do not capture the essence of a universal basic income. Yes, they are valuable in their own right, but they are temporary and the amount is too low to ensure that people feel at ease.

So, here we are. Will we wait for a couple of centuries more to install a system providing security and freedom or will we install a pragmatic and fairer upgrade of a universal basic income?

Let’s not forget that the original reason we invented an economic system in the first place was to increase the quality of our lives. A dynamic happiness income offers us a tool to do exactly that, and in this lifetime.

Want more?

Curious how we can

upgrade our economic system so it supports the quality of your life and of those you care for?

In the book

"Happonomy, Roadmap to Utopia", Bruno Delepierre takes you on a 300 page journey to explore how work, money and technology impacts the quality of your life. Expect insightful analyses, intimate portraits and 35 daring recipes for upgrade. Interested?

Take a look!

"

["post_title"]=>

string(24) "Dynamic Happiness Income"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(26) "dynamic-happiness-income-2"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(64) "

https://www.happonomy.org/en/unconditional-basic-income-flawed/"

["post_modified"]=>

string(19) "2020-05-20 15:38:27"

["post_modified_gmt"]=>

string(19) "2020-05-20 13:38:27"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(33) "https://www.happonomy.org/?p=2026"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[4]=>

object(WP_Post)#13579 (24) {

["ID"]=>

int(963)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2018-11-25 00:00:00"

["post_date_gmt"]=>

string(19) "2018-11-25 00:00:00"

["post_content"]=>

string(8130) "Company bonuses are often the best way to incentivise people to do the best they can to achieve a company goal. The goals can be anything, although they are often financially related and purely number driven; the goals themselves do not hold any ‘moral’ value.

Bonuses, in today's world, do not take into account any interest other than that of the organisation either. As a consequence, they can be used to reward behaviour that is not necessarily in the best interest of all.

The situation today

We live in a world where we expect a reward if we achieve a goal in business. This reward feeds our self-esteem, helps us to build financial security and enables us to experience or buy new things that give us a richer life.

As long as bonuses are linked to merit and achievement, we have few objections. Sometimes though, bonuses feel unjust, mainly if they are excessive towards the people receiving them.

Today, there is a clash of perspectives regarding the bonuses given in the financial sector. Bonuses of financial executives are still considered by many to be

disproportionate. Privately owned banks were saved from bankruptcy with public funds and paying executives substantial amounts of bonuses, seems unjust.

However, when looking at the perspective of the executives,

their bonus seems to be warranted; they reached goals that protect or grow the shareholder value, using the financial system we collectively created.

So what can we do?

We can resolve this seemingly diametrical opposition, but it requires

a leap in perspective with those working in the financial sector. If we understand that the financial system is not a goal in itself, but just a means to procure a high-quality life all people, including themselves, then the insatiable hunger for bonuses may be halted.

Unfortunately, changing perspectives of people takes a long time. Radical systemic events like wars and financial crashes or personal events like the death of a loved one can be catalysts. Without them though, we need intermediate solutions.

Are New Key Performance Indicators A Solution?

As long as we require a monetary incentive to perform to the best of our abilities, bonuses seem to be the way forward. As you’ll read later though, bonuses have very limited impact, suggesting that we could get rid of them and not much would change. However, for now, let us assume that we do keep purely financial bonus structures.

The question arises about how we can align them according to behaviour that takes into account the interests of all parties involved.

In theory, the answer is simple:

companies can transcend their own financial shareholder value and weigh in all interests in their bonus schemes.

We can explore an example to see how this could be put into practice.

Suppose a company is profitable but it wants to restructure its organisation. As they close down a profitable entity of their company, they decide to lay off 500 people. Most of us would feel bonuses out of place in this situation. However, company boards and shareholders do use these kinds of criteria

to reward their management team.

Zooming in on the different stakeholders impacted, it is clear that the shareholders are the main beneficiaries. On the other hand, the company employees on the other hand are those who are directly negatively impacted; they lose their jobs and financial security because of profit maximisation purposes.

Indirectly, society as a whole is also negatively impacted; social benefit costs increase when people are laid off.

In the case described above, we have one stakeholder (the shareholders) that profits and two stakeholders (the employees and society) who experience negative impact. A variety of bonus mechanisms can be applied, depending on the extent to which one is willing to focus on the kind of value that is created.

If an organisation focuses on the private value instead of the societal value, only a percentage of the original bonus can paid.

As we have only have one out of every three stakeholders benefiting from the action, an organisation can choose to pay only 33% of the total bonus.

The other point of view emphasises the societal value over the private value: if there is one stakeholder that is not benefiting from a company measure, no bonus is paid at all.

Something to think about: do bonuses work at all?

In his book

“The surprising thruth about what motivates us”, social scientist Dan Pink shows that bonuses only make sense if people have to execute repetitive and mainly uncreative tasks.

In other types of activities, the fact that people can apply their talents and work creatively and independently is much more motivating. Bonuses in this scenario only give a quick motivational fix.

Both from a motivational and a financial point of view, this is sub-optimal. Yet, in today’s business culture, bonuses are widespread amongst top executives.

So, the questions that company owners, managers and policy makers need to ask are, "Why do we need bonuses?" and "Do we believe top talent will not be willing to work for a generous salary provided they believe in the organisation's mission where they can grow their skills?"

Shareholders can appoint executives who are intrinsically motivated by what an organisation does rather than the potential size of their bonus.

Do you know what the irony is?

The bottom line will bloom by doing just that...

Want more?

What about you? What intrinsically motivates you?

Do you know the answer to that question? If you don't know what motivates you, you can use our Happonomy Value Canvas freely to find out.

Go check it out! And yes, it is free."

["post_title"]=>

string(27) "Societally Balanced Bonuses"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(27) "societally-balanced-bonuses"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-17 09:02:06"

["post_modified_gmt"]=>

string(19) "2019-07-17 09:02:06"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(66) "https://www.happonomy.org/creativity/societally-balanced-bonuses-2/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[5]=>

object(WP_Post)#13574 (24) {

["ID"]=>

int(952)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2018-09-15 00:00:00"

["post_date_gmt"]=>

string(19) "2018-09-15 00:00:00"

["post_content"]=>

string(13719) "You know what they say: “what gets measured gets managed”.

In our society today, economic measurements dominate the debate. We are talking about how much our economies grow, how much debt a nation has and what the employment ratio is. You may come up with some other economic metrics yourselves.

Let’s dive into the main metric we use today and explore which alternatives could work...

What we measure today - GDP

First, let’s look at what we measure today. At the core of the economic metrics is the

Gross Domestic Product (GDP). Simply put, it is the turnover of a country or the value of all goods and services produced within a country's borders.

To avoid confusion, this is not the production of all people with the same nationality. That is called the Gross National Product (

GNP). So, foreign people living in your country contribute to the GDP but not the GNP of your country. Oppositely, your fellow countrymen living abroad do not contribute to your country’s GDP but they do add to the GNP.

The

GDP initially requires correction for the impact of inflation because inflation increases the GDP without having any additional production. This corrected GDP is a metric that captures the real expansion of creation of goods and services very well.

It includes the production of consumer goods and services, government spending and even investment goods. It also discounts goods that are used as production goods for other goods (‘intermediate goods’).

Four questions about using GDP as a metric

1. Do we all use the same definition of GDP?

The answer is "no".

It may come as a surprise that countries do not have a uniform interpretation of the GDP metric. Several of the G20 economies have modified their definition of what GDP consists of over the last few years, all suggesting growth of their economies.

For instance, the

United States mid-2013 added a couple of variables, growing their economy by 3%, one day to the other. It may be quite valid to add R&D to the equation or even adding future pension payments. There is nothing wrong with that per se but it does render

comparing economies impossible.

It is like comparing apples with bananas.

Another example is India, whose

GDP grew from 4.7% to 6.9% in 2014, just by modifying the way that their GDP is calculated. Again, there is no blame to India for doing this, but it does illustrate that

GDP is not an ‘absolute’ number.

Finally, in the EU, several countries also added parameters to the equation. France refused. We will not tell you what they added yet; read on to find out. So, even within the EU block, different metrics for GDP are used.

2. Do we measure GDP accurately today?

A second question one needs to ask himself is, "Even with different definitions, do we measure GDP properly?" Again, the answer again is "no".

In order to be able to come to a correct figure, one needs to

receive the correct data. This is where things go wrong. By definition, governments don’t have any reliable statistics available on underground economies. So, it is an educated guess at best.

The economic infrastructure varies vastly across the world and not every country is able to gather all numbers, as you need a

generally recognised central government to be able to report all statistics.

Countries struck by civil war are already excluded as they don’t receive statistics or taxes from parts of the country. This means that countries like Syria, Iraq or Afghanistan are unable to calculate credible GDPs.

Thirdly, some components of the GDP equation are not objectively measurable.

The contribution of government services like education or health does not have an objective ‘market’ price as it is the government that regulates the wages of teachers and doctors. This means that policy decisions which are by their nature ‘subjective’, have an impact on the GDP metric.

3. Does GDP contain everything that increases quality of life?

Provided one agrees with the fact that are economy should be designed to propel us forward, does the GDP metric take into account the things we find valuable?

Once again the answer is "no".

GDP as a metric provides an indication of output, irrespective of the fact of whether something is considered to be wanted or not.

So, the first question we need to ask is: what do we want? Only then can we create a statistic to mean something that better encapsulates what we need.

There are also some paradoxes in the GDP calculation. For instance, we do not economically value the hours we care for our children, while if we hire a babysitter or nanny this is considered to be valuable and part of the equation.

If you have children, you know how valuable spending time with them is. So why isn't this value taken into the GDP? It is a service you provide to another person. You are just not getting formally paid for it.

This suggests a design flaw present across our entire economic system:

economy is reduced to money driven transactions, not transactions that create value.

4. Does it measure what we want?

The general public is so used to hearing about GDP that we do not reflect on its contents or its goal anymore.

We need to ask ourselves the question:

do we want to measure growth for the sake of growth alone? Aren't we better of measuring that what improves our quality of life and well-being instead?

GDP does not measure fairness nor the sustainability of the actual production.

It may sound a bit cynical: GDP is better off to have environment pollution as this creates new “production”.

- In healthcare, people need to be treated more because pollution makes them sick. We also sell more medicine.

- In technology, we aspire to develop new clean technology to solve the pollution problem, hence creating new industries.

- In financial products, we created an emission trading system to pay for the possibility to exhaust greenhouse gases.

Prostitution and drugs

Earlier in the article, we mentioned that several EU countries had added parameters to their GDP, but didn't tell which ones were added. Well, here it is: Did you know that recently several countries like

Spain,

Italy and the

UK expanded the GDP metric with the production value of

prostitution and drugs?

It is understandable that we measure these things for policy reasons. However, do we want the ‘value’ of these activities in our key economic metric indicating how well our economy is doing?

The alternatives

What would it take to have an alternative to GDP?

It is easy to be a critic, but it is probably more valuable to try to find an alternative.

Firstly, let us look at what we would expect from an alternative guiding metric. At its core it should

monitor the progress of individuals and the quality of life, so we can improve it. The four key differences with GDP are that:

- It does not look at the territory: it looks at the people and their nationality, much like gross national product (GNP). As long as nationality is a legal construct from where people can derive rights, nationality is more important than territory. One exception to this rule would be people with dual nationalities. There, territory would be more important and the country where a person lives would determine to what GDP they contribute.

- It does not make a judgement of what type of production and output we want. Hence, illegal activities aren't taken into account. It may be tempting to state some other types of production may be discounted as well. For instance, do we want cigarette sales in our new economic metric? Tempting and valuable as it is to start discounting items, it is better to first measure all parameters which countries agree are valuable. Only a common base allows objective comparison. Discounting things - if needed at all - like France did with prostitution and drugs, does remain a valuable metric on a national level though.

- It takes into account all value created, not just the value that is measured by our monetary system. This means time spent with your children or taking care for a sick family member is also in that metric.

- It should be built on a science other than economics. Economic science, like law, is a human science, in that it is based on conventions. Biology and psychology aren't. The metric should take into account the insights from biology and psychology which drives our quality of life. If new insights arise, the metric should be adjusted accordingly.

Alternative metric systems

There are literally dozens of alternative ‘value systems’ available, both on a macro- and a micro-level. We can choose to create a new one, or work from an existing one.

To be clear, this article does not aim to state any preferences; rather, it illustrates what can be considered. Each system will very likely have its own potential flaws or differences. As long as we don’t collectively agree on all what we want to achieve, this will always be the case.

That should not be an excuse to not move forward. Take a look at what exists already!

Gross National Happiness Index - The Kingdom of Bhutan is well known for its alternative economic system focusing on happiness. You can read more about it

here.

OECD guidelines for measuring well-being - The OECD, the Organisation for Economic Co-operation and Development, has extensive policy guidelines to measure ‘subjective well-being’ in our economy.

The Prosperity Index - This has been built by the Legatum Institute for 142 countries. It looks at 8 categories and 92 parameters.

The Happy Planet Index - This was built by NEF (New Economics Foundation), a UK think-thank.

The Human Development Index - This is governed by the UNDP (United Nations Development Programme).

We are sure there are many more.

Don’t forget it all starts with just

one question: "What do you want in life?" Measure that and we are well on the way.

Want more?

In the mood for more food for thought?

We redesigned our money system in a way that it supports our quality of life. We call it the Sustainable Money System. Do you want to find out more about it? Go explore the model!"

["post_title"]=>

string(46) "Modify What We Measure - An Alternative To GDP"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(22) "modify-what-we-measure"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-17 09:07:30"

["post_modified_gmt"]=>

string(19) "2019-07-17 09:07:30"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(59) "https://www.happonomy.org/creativity/modify-what-we-measure/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[6]=>

object(WP_Post)#13573 (24) {

["ID"]=>

int(984)

["post_author"]=>

string(3) "340"

["post_date"]=>

string(19) "2017-11-24 00:00:00"

["post_date_gmt"]=>

string(19) "2017-11-24 00:00:00"

["post_content"]=>

string(14799) "

Money is the blood of our economy.

Our political leaders lose sleep over it, and the chances are that you do as well. Newspapers contain endless articles on it. You can find countless books and theories about money. Where it flows, it creates abundance; where it is scarce, struggle and decay follows, just like organs dying when starved of blood.

Money is a strange beast; after handling it, it makes us less willing to help others. It’s hard to believe that this peculiarity actually starts at the age of three! However, human beings are inherently social and are generally geared towards sharing and collaboration.

Money is perceived as scarce. It always seems that we have too little of it. Paradoxically, did you know that it is us who decide how much money we create? Yes, money is a man-made system. It’s a bit like software, and just like software, money can be designed.

It becomes increasingly clear that the current design is flawed.

Today, there are too many crucial areas where there is a shortage of money, or in other words, where the flow of money is hampered. Examples of these ‘underflowed’ areas are people in poverty, our education system and our health and environmental care, to name just a few.

We should ask ourselves the following questions:

- “Does money serve us or are we serving it?”

- “What would happen if we redesign the monetary blueprint in such a way that it puts our quality of life and well-being at the front and centre?”

- “Shouldn’t that be our main objective?”

The good news is that it is possible! However, let’s have a look at the current design first.

Our current money design

Today, you can acquire money in four distinct ways:

- by taking out a loan;

- by doing paid work;

- by an inheritance or through successful investments;

- by creating a passive income.

The currencies that are used in our current monetary system - of which some of the most important are: Euros, Dollars, Pounds, Yen, Peso and Yuan - are mostly created by banks when you take out a loan, and then pay it back with interest. Money is also taken out of circulation once you pay back a loan.

Simply put, it works as follows: when you take out a loan, your debt to the bank consists of two parts, namely the capital debt, which is the amount deposited in your bank account, and the interest debt.

When you pay back the main sum (i.e. the capital debt), it is taken out of circulation. On the other hand, the surplus (the interest debt), is income for the bank and is not taken out of circulation.

For a more detailed explanation about how our current system works, take a look here.

Our current design is flawed. If not mitigated by redistribution systems, this design favours those who already have a lot of wealth; the growing inequalities between the very rich and the poor highlight this. The surreal part is that, even for many objectively rich people, the design doesn’t provide a happy life.

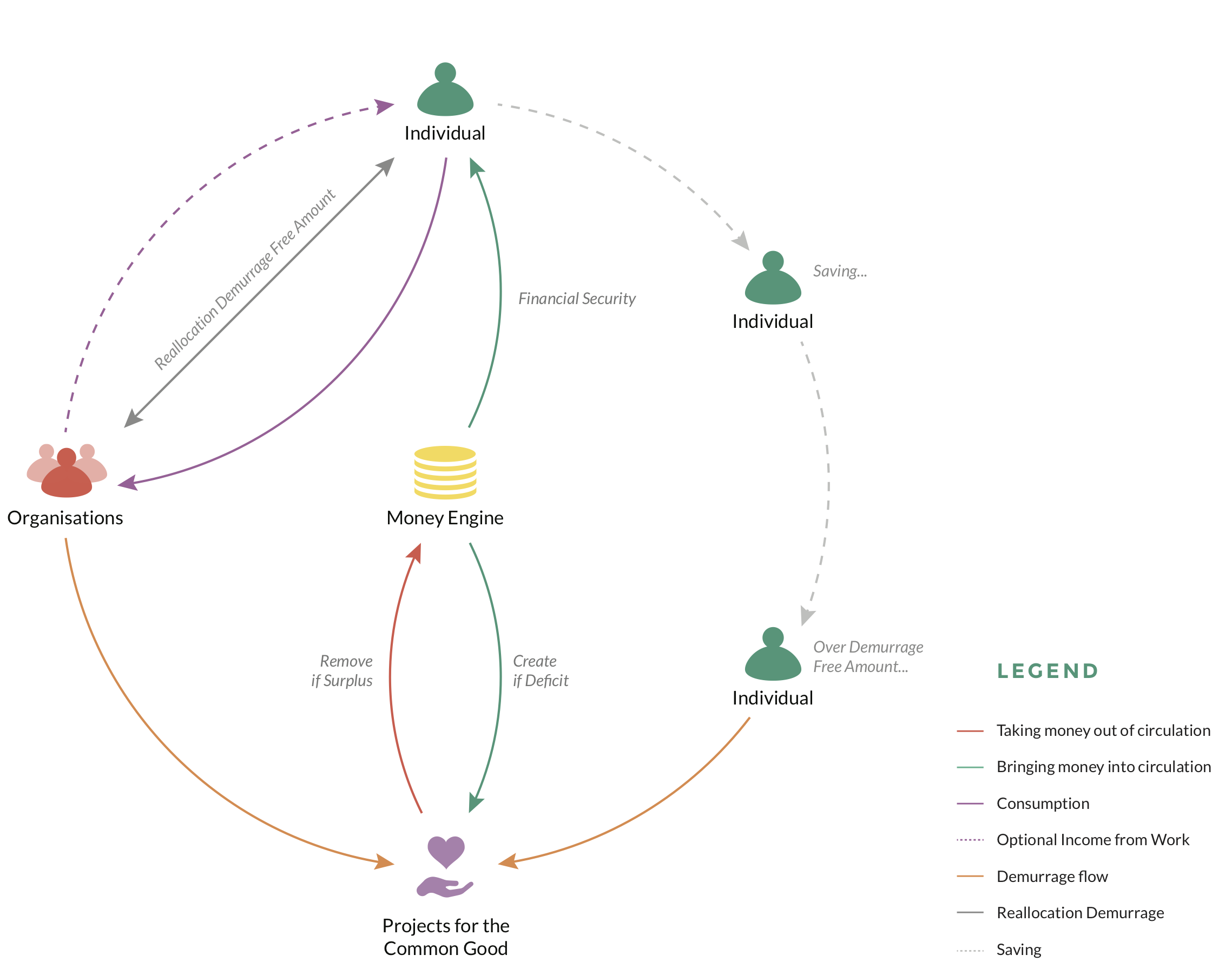

An improved design: The Sustainable Money System (SuMSy)

What if we could recognise everyone’s potential and acknowledge that financially? What about financing services to society? What if education, healthcare, environmental care and other services always had enough money for each of them to deliver their own value?

What if we created the money for that? Since money is 100% man-made, we can design a monetary system that ensures money always flows to where it is needed.

SuMSy is a monetary design to make people feel more optimistic about the future and to unlock the innate goodness of people.

SuMSy is built on three pillars:

- Everybody will always have the financial security from a guaranteed income.

- It provides funding to those services which we find inherently valuable to our society.

- Money keeps on flowing.

These three pillars add to our individual and collective wellbeing.

Financial anxiety is largely reduced, as we can ensure that we have qualitative services to support a well-functioning society and, because money is in constant flow, getting access to it for your value driven projects becomes easier. This is partly because you can always tap into your guaranteed income and partly because people will be more willing to invest in intrinsically valuable projects than they are today. The need for financial return on investments will be reduced.

A first introduction to the three pillars of SuMSy

SuMSy creates money for a guaranteed unconditional income. The reason is straightforward: when we feel financially secure, our stress levels are reduced, which is a gateway to the improvement of other facets of our lives. Because the money is created, we don’t have to worry about how it will be financed.

By now, you might be saying: “Hold on, you can’t just keep on creating money! It will cause inflation! Prices will rise and money will lose its value!”

Demurrage: the shield against hyperinflation.

When money is constantly being created, it starts to lose its value. If new money is added, prices rise, meaning that you’ll need more money to buy the same product. There are plenty of examples out there and one of the most notable is what happened in Germany after World War I.

Therefore, constant creation needs to be balanced by taking some money out of circulation too. To make sure that money is removed from the system, we need to introduce two things:

- A ‘demurrage free amount’: this is an upper limit on everyone’s account balance above which holding on to money is no longer free.

- A ‘monetary capital fee’ or ‘demurrage fee’ in economic terms: this fee is a small percentage of the amount above the ‘demurrage free amount’.

If this sounds too technical, let’s explore an example to make it clearer.

Imagine that the ‘demurrage free amount’ is set at 25,000 SuMSy Euros and the demurrage fee is 0.2% per month. This means that you can keep those 25,000 SuMSy Euros forever, and for free, on your account.