Money is the blood of our economy.

Our political leaders lose sleep over it, and the chances are that you do as well. Newspapers contain endless articles on it. You can find countless books and theories about money. Where it flows, it creates abundance; where it is scarce, struggle and decay follows, just like organs dying when starved of blood.

Money is a strange beast; after handling it, it makes us less willing to help others. It’s hard to believe that this peculiarity actually starts at the age of three! However, human beings are inherently social and are generally geared towards sharing and collaboration.

Money is perceived as scarce. It always seems that we have too little of it. Paradoxically, did you know that it is us who decide how much money we create? Yes, money is a man-made system. It’s a bit like software, and just like software, money can be designed.

It becomes increasingly clear that the current design is flawed.

Today, there are too many crucial areas where there is a shortage of money, or in other words, where the flow of money is hampered. Examples of these ‘underflowed’ areas are people in poverty, our education system and our health and environmental care, to name just a few.

We should ask ourselves the following questions:

- “Does money serve us or are we serving it?”

- “What would happen if we redesign the monetary blueprint in such a way that it puts our quality of life and well-being at the front and centre?”

- “Shouldn’t that be our main objective?”

The good news is that it is possible! However, let’s have a look at the current design first.

Our current money design

Today, you can acquire money in four distinct ways:

- by taking out a loan;

- by doing paid work;

- by an inheritance or through successful investments;

- by creating a passive income.

The currencies that are used in our current monetary system – of which some of the most important are: Euros, Dollars, Pounds, Yen, Peso and Yuan – are mostly created by banks when you take out a loan, and then pay it back with interest. Money is also taken out of circulation once you pay back a loan.

Simply put, it works as follows: when you take out a loan, your debt to the bank consists of two parts, namely the capital debt, which is the amount deposited in your bank account, and the interest debt.

When you pay back the main sum (i.e. the capital debt), it is taken out of circulation. On the other hand, the surplus (the interest debt), is income for the bank and is not taken out of circulation.

For a more detailed explanation about how our current system works, take a look here.

Our current design is flawed. If not mitigated by redistribution systems, this design favours those who already have a lot of wealth; the growing inequalities between the very rich and the poor highlight this. The surreal part is that, even for many objectively rich people, the design doesn’t provide a happy life.

An improved design: The Sustainable Money System (SuMSy)

What if we could recognise everyone’s potential and acknowledge that financially? What about financing services to society? What if education, healthcare, environmental care and other services always had enough money for each of them to deliver their own value?

What if we created the money for that? Since money is 100% man-made, we can design a monetary system that ensures money always flows to where it is needed.

SuMSy is a monetary design to make people feel more optimistic about the future and to unlock the innate goodness of people.

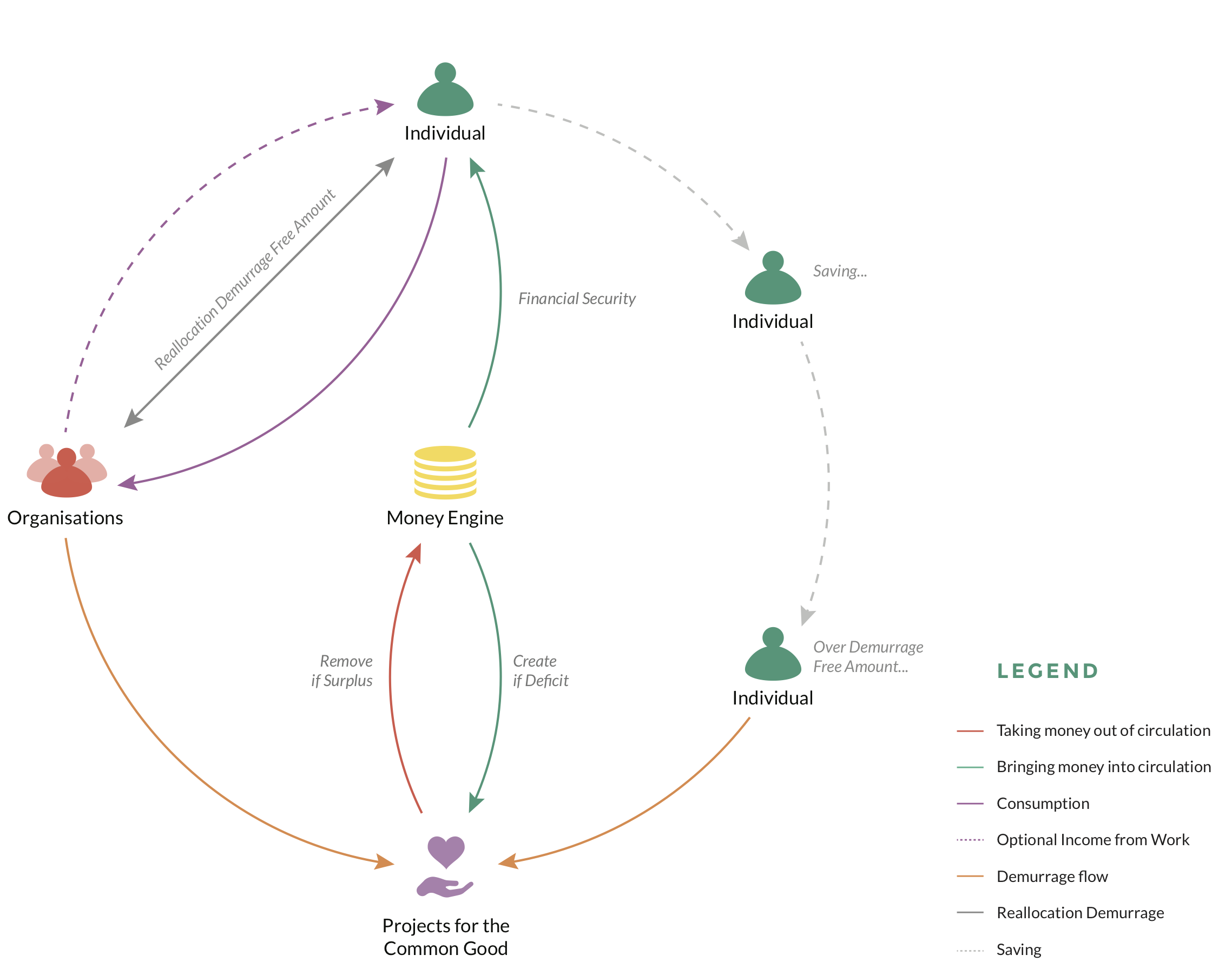

SuMSy is built on three pillars:

- Everybody will always have the financial security from a guaranteed income.

- It provides funding to those services which we find inherently valuable to our society.

- Money keeps on flowing.

These three pillars add to our individual and collective wellbeing.

Financial anxiety is largely reduced, as we can ensure that we have qualitative services to support a well-functioning society and, because money is in constant flow, getting access to it for your value driven projects becomes easier. This is partly because you can always tap into your guaranteed income and partly because people will be more willing to invest in intrinsically valuable projects than they are today. The need for financial return on investments will be reduced.

A first introduction to the three pillars of SuMSy

SuMSy creates money for a guaranteed unconditional income. The reason is straightforward: when we feel financially secure, our stress levels are reduced, which is a gateway to the improvement of other facets of our lives. Because the money is created, we don’t have to worry about how it will be financed.

By now, you might be saying: “Hold on, you can’t just keep on creating money! It will cause inflation! Prices will rise and money will lose its value!”

Demurrage: the shield against hyperinflation.

When money is constantly being created, it starts to lose its value. If new money is added, prices rise, meaning that you’ll need more money to buy the same product. There are plenty of examples out there and one of the most notable is what happened in Germany after World War I.

Therefore, constant creation needs to be balanced by taking some money out of circulation too. To make sure that money is removed from the system, we need to introduce two things:

- A ‘demurrage free amount’: this is an upper limit on everyone’s account balance above which holding on to money is no longer free.

- A ‘monetary capital fee’ or ‘demurrage fee’ in economic terms: this fee is a small percentage of the amount above the ‘demurrage free amount’.

If this sounds too technical, let’s explore an example to make it clearer.

Imagine that the ‘demurrage free amount’ is set at 25,000 SuMSy Euros and the demurrage fee is 0.2% per month. This means that you can keep those 25,000 SuMSy Euros forever, and for free, on your account.

Anything above that 25,000 SuMSy Euros is impacted by a demurrage fee, which is a charge for keeping more than 25,000 SuMSy Euros. For the sake of this example, we have set this demurrage fee at 0.2% per month.

Imagine that someone has 30,000 SuMSy Euros in their account. That person would have to pay 0.2% per month on the 5,000 SuMSy Euros above the ‘demurrage free amount’ of 25,000 SuMSy Euros. In this case, that would be 10 SuMSy Euros per month.

This means the amount of money you have is reduced until you have 25,000 SuMSy Euros in your account. SuMSy never impacts your core financial security.

The money coming from the demurrage fee isn’t going to waste though: you choose which project for the common good is funded with the fee you are paying. When you don’t make use of that choice, the collected money is used to pay for financing services to society and is distributed equally among them.

When a service such as education, environmental protection or health care is overfunded, the surplus money is taken out of circulation. When a service is underfunded, extra money is created for it. That way, we make sure that no services are ever underfunded and by taking surplus money out of circulation, we keep the total amount of money in check, thereby guarding against inflation.

The demurrage fee has another significant effect. Because holding onto money starts costing money, an incentive is created to make the money flow, and that stimulates the economy in a balanced way.

Where we are & a call to action

Will SuMSy solve all our problems?

The simple answer is “no”. Money is just a number, or a vessel for value. Until we have the same outlook on the things that are truly valuable to us, frictions will arise.

That being said, an appropriately designed monetary system can go a long way and, as you know, thinking about building the perfect system is often an excuse to do nothing.

That’s why Happonomy has a few initiatives within the monetary sphere on its radar. Building and experimenting with this new SuMSy model is one of them.

As with software, it all starts with a Minimal Viable Product or MVP, which was the first version to explore the possibilities and to upgrade the design.

If you want to play around with the model, take the following simulations for a spin and see what happens.

- Single account simulation in the current system.

- Single account simulation in the Circular Money Design.

- Total monetary mass simulation in the Circular Money Design.

Would you like to help design new systems to improve the quality of our lives? Join us.

Want more?

In the mood for more food for thought? We redesigned our money system in a way that it supports our quality of life. We call it the Sustainable Money System. Do you want to find out more about it? Go explore the model!

Leave a reply