object(WP_Query)#11330 (62) {

["query"]=>

array(4) {

["paged"]=>

string(1) "2"

["tag"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["lang"]=>

string(2) "en"

["post_type"]=>

array(2) {

[0]=>

string(12) "tribe_events"

[1]=>

string(4) "post"

}

}

["query_vars"]=>

array(68) {

["paged"]=>

int(2)

["tag"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["lang"]=>

string(2) "en"

["error"]=>

string(0) ""

["m"]=>

string(0) ""

["p"]=>

int(0)

["post_parent"]=>

string(0) ""

["subpost"]=>

string(0) ""

["subpost_id"]=>

string(0) ""

["attachment"]=>

string(0) ""

["attachment_id"]=>

int(0)

["name"]=>

string(0) ""

["pagename"]=>

string(0) ""

["page_id"]=>

int(0)

["second"]=>

string(0) ""

["minute"]=>

string(0) ""

["hour"]=>

string(0) ""

["day"]=>

int(0)

["monthnum"]=>

int(0)

["year"]=>

int(0)

["w"]=>

int(0)

["category_name"]=>

string(0) ""

["cat"]=>

string(0) ""

["tag_id"]=>

int(83)

["author"]=>

string(0) ""

["author_name"]=>

string(0) ""

["feed"]=>

string(0) ""

["tb"]=>

string(0) ""

["meta_key"]=>

string(0) ""

["meta_value"]=>

string(0) ""

["preview"]=>

string(0) ""

["s"]=>

string(0) ""

["sentence"]=>

string(0) ""

["title"]=>

string(0) ""

["fields"]=>

string(0) ""

["menu_order"]=>

string(0) ""

["embed"]=>

string(0) ""

["category__in"]=>

array(0) {

}

["category__not_in"]=>

array(0) {

}

["category__and"]=>

array(0) {

}

["post__in"]=>

array(0) {

}

["post__not_in"]=>

array(0) {

}

["post_name__in"]=>

array(0) {

}

["tag__in"]=>

array(0) {

}

["tag__not_in"]=>

array(0) {

}

["tag__and"]=>

array(0) {

}

["tag_slug__in"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["tag_slug__and"]=>

array(0) {

}

["post_parent__in"]=>

array(0) {

}

["post_parent__not_in"]=>

array(0) {

}

["author__in"]=>

array(0) {

}

["author__not_in"]=>

array(0) {

}

["search_columns"]=>

array(0) {

}

["post_type"]=>

array(2) {

[0]=>

string(12) "tribe_events"

[1]=>

string(4) "post"

}

["update_post_term_cache"]=>

bool(true)

["ignore_sticky_posts"]=>

bool(false)

["suppress_filters"]=>

bool(false)

["cache_results"]=>

bool(true)

["update_menu_item_cache"]=>

bool(false)

["lazy_load_term_meta"]=>

bool(true)

["update_post_meta_cache"]=>

bool(true)

["posts_per_page"]=>

int(9)

["nopaging"]=>

bool(false)

["comments_per_page"]=>

string(2) "50"

["no_found_rows"]=>

bool(false)

["taxonomy"]=>

string(8) "language"

["term"]=>

string(2) "en"

["order"]=>

string(4) "DESC"

}

["tax_query"]=>

object(WP_Tax_Query)#13726 (6) {

["queries"]=>

array(2) {

[0]=>

array(5) {

["taxonomy"]=>

string(8) "language"

["terms"]=>

array(1) {

[0]=>

string(2) "en"

}

["field"]=>

string(4) "slug"

["operator"]=>

string(2) "IN"

["include_children"]=>

bool(true)

}

[1]=>

array(5) {

["taxonomy"]=>

string(8) "post_tag"

["terms"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["field"]=>

string(4) "slug"

["operator"]=>

string(2) "IN"

["include_children"]=>

bool(true)

}

}

["relation"]=>

string(3) "AND"

["table_aliases":protected]=>

array(2) {

[0]=>

string(21) "hy_term_relationships"

[1]=>

string(3) "tt1"

}

["queried_terms"]=>

array(2) {

["post_tag"]=>

array(2) {

["terms"]=>

array(1) {

[0]=>

string(36) "feel-at-easefinancial-securitypolicy"

}

["field"]=>

string(4) "slug"

}

["language"]=>

array(2) {

["terms"]=>

array(1) {

[0]=>

string(2) "en"

}

["field"]=>

string(4) "slug"

}

}

["primary_table"]=>

string(8) "hy_posts"

["primary_id_column"]=>

string(2) "ID"

}

["meta_query"]=>

object(WP_Meta_Query)#13727 (9) {

["queries"]=>

array(0) {

}

["relation"]=>

NULL

["meta_table"]=>

NULL

["meta_id_column"]=>

NULL

["primary_table"]=>

NULL

["primary_id_column"]=>

NULL

["table_aliases":protected]=>

array(0) {

}

["clauses":protected]=>

array(0) {

}

["has_or_relation":protected]=>

bool(false)

}

["date_query"]=>

bool(false)

["queried_object"]=>

object(WP_Term)#13744 (10) {

["term_id"]=>

int(83)

["name"]=>

string(38) "feel at ease|financial security|policy"

["slug"]=>

string(36) "feel-at-easefinancial-securitypolicy"

["term_group"]=>

int(0)

["term_taxonomy_id"]=>

int(83)

["taxonomy"]=>

string(8) "post_tag"

["description"]=>

string(0) ""

["parent"]=>

int(0)

["count"]=>

int(17)

["filter"]=>

string(3) "raw"

}

["queried_object_id"]=>

int(83)

["request"]=>

string(1101) "

SELECT SQL_CALC_FOUND_ROWS hy_posts.ID

FROM hy_posts LEFT JOIN hy_term_relationships ON (hy_posts.ID = hy_term_relationships.object_id) LEFT JOIN hy_term_relationships AS tt1 ON (hy_posts.ID = tt1.object_id)

WHERE 1=1 AND (

hy_term_relationships.term_taxonomy_id IN (2)

AND

tt1.term_taxonomy_id IN (83)

) AND ((hy_posts.post_type = 'tribe_events' AND (hy_posts.post_status = 'publish' OR hy_posts.post_status = 'acf-disabled' OR hy_posts.post_status = 'tribe-ea-success' OR hy_posts.post_status = 'tribe-ea-failed' OR hy_posts.post_status = 'tribe-ea-schedule' OR hy_posts.post_status = 'tribe-ea-pending' OR hy_posts.post_status = 'tribe-ea-draft')) OR (hy_posts.post_type = 'post' AND (hy_posts.post_status = 'publish' OR hy_posts.post_status = 'acf-disabled' OR hy_posts.post_status = 'tribe-ea-success' OR hy_posts.post_status = 'tribe-ea-failed' OR hy_posts.post_status = 'tribe-ea-schedule' OR hy_posts.post_status = 'tribe-ea-pending' OR hy_posts.post_status = 'tribe-ea-draft')))

GROUP BY hy_posts.ID

ORDER BY hy_posts.post_date DESC

LIMIT 9, 9

"

["posts"]=>

&array(8) {

[0]=>

object(WP_Post)#13723 (24) {

["ID"]=>

int(979)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2017-07-03 00:00:00"

["post_date_gmt"]=>

string(19) "2017-07-03 00:00:00"

["post_content"]=>

string(1151) "If you are curious how

happiness, money and work influence each other, take a look at the TEDx talk of Bruno, the Happonomy coordinator.

Bruno also explores some types of solutions to realign work and money towards the quality of our lives and

upgrade our economy.

Want more?

Want more? Don't be sad that the video is over! We got plenty of other exciting stuff to share with you. Subscribe to our bi-monthly newsletter and we'll keep you up to date with our latest news!"

["post_title"]=>

string(41) "How capitalism can increase our happiness"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(24) "capitalism-and-happiness"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-17 11:27:56"

["post_modified_gmt"]=>

string(19) "2019-07-17 11:27:56"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.happonomy.org/creativity/capitalism-and-happiness/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[1]=>

object(WP_Post)#13719 (24) {

["ID"]=>

int(978)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2017-05-19 00:00:00"

["post_date_gmt"]=>

string(19) "2017-05-19 00:00:00"

["post_content"]=>

string(6301) "

We can cure capitalism - Part 1 - Diagnosis

Whether you are on the receiving end of our capitalist system or whether you are struggling, you probably see that the pressure on many people is growing day by day.

If you are wondering why so many people are feeling lost, why so many people are exhausted and frustrated in today’s society, the diagnosis is simple: we have built a system of work and money that doesn’t fully align with the things we truly need…

What do we need?

Face it, chances are you haven’t given this much conscious thought. Science has though: emerging research from the fields of behavioral economics, positive psychology and cognitive sciences are able to paint a clear picture of those things we find valuable, what drives the quality of our lives.

There are 21 building blocks to our happiness, and they can be bundled into 5 large dimensions.

1. we all want to survive

2. we want to feel at ease

3. we are social beings so we want to connect

4. we want to grow

5. we want to be part of something bigger

Why do we work?

If you would ask people the question "why do you work", you would often get the answer “to earn enough money to pay the bills”. And that is obviously true, in our current system we have linked money and the financial security that comes from this with work.

There are 3 other reasons though why people go to work. And guess what, they connect back to the things we need.

We go to work because we want to connect, because we like to have a coffee with colleagues and discuss the latest TV show, we go to work because we want to grow, learn and apply our talent in a challenging job. And we also go to work because we want to contribute to something bigger, and what better thing to contribute to than the mission of an organization?

Where our system goes wrong

Our current system is failing us. It overemphasizes our need for personal growth, competition and efficiency. As a consequence, our current system increasingly fails to deliver the financial security we crave - people lose their jobs because of globalization and robotization - and at the same time we have thrown the potential for true connection and purpose under the bus.

The symptoms? They are abundantly out there. One in two people in Belgium expects to burn-out at a certain moment in their careers. Over the last 10 years, the number of people in the EU that are without work for an extended time or have a job but still live in poverty, has risen by almost a third.

Add money to the mix

Money, the second ingredient of our system, does strange things to people. It impacts our motivation, our health and our happiness. Our monetary system is built on debt and scarcity, two things that are psychologically far from neutral. In the EU alone over 10.000 people committed suicide because of financial problems after the 2008 financial crisis. Studies from researchers at Stanford and Berkeley showed that our debt based, scarcity driven monetary system hurts the brain development of children as young as 18 months.

Where does that leave us?

It seems we are stuck right? Stuck in a system where we need to work more and more and struggle to receive less and less, all this with a big bag of debt on our backs, pushing us down.

The good news is that it will be our generations who will decide whether we will use our economy and technology to improve the quality of our lives or whether we’ll sacrifice our happiness for the sake of economics.

And there is more good news, we don’t need a revolution, we can start small.

Coming next week:

Part two - Explore 4 types of solutions we can deploy.

Want more?

In the mood for more food for thought? We redesigned our money system in a way that it supports our quality of life. We call it the Sustainable Money System. Do you want to find out more about it? Go explore the model!

"

["post_title"]=>

string(22) "We can cure capitalism"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(22) "we-can-cure-capitalism"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 15:23:07"

["post_modified_gmt"]=>

string(19) "2020-05-20 13:23:07"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(59) "https://www.happonomy.org/creativity/we-can-cure-capitalism/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[2]=>

object(WP_Post)#13720 (24) {

["ID"]=>

int(970)

["post_author"]=>

string(2) "35"

["post_date"]=>

string(19) "2015-09-23 00:00:00"

["post_date_gmt"]=>

string(19) "2015-09-23 00:00:00"

["post_content"]=>

string(6268) "Migration is a phenomenon that has been around for centuries. Groups of people have migrated for different reasons throughout history, reasons such as:

- War;

- Poverty;

- Hunger;

- Slavery;

- Political or religious turmoil;

- Natural disasters.

Migration is something that is naturally part of an ever-changing world. There will always be events that force groups of people on our planet to look for their safety and the fulfilment of their basic needs elsewhere.

The current refugee crisis is no exception.

Thousands of refugees are pouring into Europe on a daily basis, fleeing from the violence in countries such as Syria and Afghanistan.

What the demographics tell us

The large majority of refugees are usually young, healthy and ambitious people, who are trying to make the best of their situation and who are anxious to rebuild their lives, either back at home or, if that is not possible, in a new country.

When we look at the

demographics of the Syrian refugees for instance, we see that 51.1% of refugees are children, 23.9% are females aged 18 to 59, and 21.8% are males aged 18 to 59.

Opportunity instead of burden

German officials have announced that they are willing to accept around 500,000 new refugees each year.

Why are they doing this?

The answer is fairly simple:

Germany doesn’t see the large influx of young refugees as a threat or a burden, but as an economic opportunity.

Germany has a long history of foreigners coming into the country and representing a net positive for its economy. There are almost seven million foreigners living in Germany who pay more in taxes and social security than they receive in social benefits. In 2012, this created a surplus of

twenty two billion euros for Germany.

With an ageing and shrinking population, Germany hopes that welcoming refugees will boost population growth,

increase the workforce, stabilise the state pension system and increase the demand for goods and services, especially in areas which have a declining population.

Furthermore, the ageing of the population does not only affect Germany. In fact, the European Commission believes that

the ageing of Europe is one of its most serious social and economic challenges. More than one fifth of all Europeans will be at least sixty five years old by 2025, which will put a great pressure on social services and health care.

Looking past the initial costs

Recent studies performed in the United States support the expectation that

refugees can make a positive economic contribution to their new country.

For example, the Refugee Services Collaborative (RSC) of Greater Cleveland spent about $4.8 million in 2012 as they helped refugees become established in the area. However, the economic impact of those refugees on the community brought in about $48 million, roughly ten times the initial resettlement costs.

The same study also showed that

"refugees are more likely to be entrepreneurial and enjoy higher rates of successful business ventures compared to natives."

A study performed in Denmark in 2014 showed that that the refugee population in their country ultimately had a positive impact on local wage gains.

Migration as an economic asset

More and more

studies have suggested that developed countries who have sufficient employment opportunities available, can effectively bear the high costs associated with getting refugees settled in and can potentially benefit economically from opening their borders to them.

A generous immigration policy, where refugees are given the

opportunity to reach their full potential, is likely to be the most positive policy for all people involved.

The essence of migration

We have seen that refugees can be assets to our economies. However, although there are many people in the West who are entrenched in a cost/benefit analysis, this should only be a secondary concern.

Money should be secondary to people’s survival.

Above all else, we shouldn’t forget that these people are just like you and me, even though they speak a different language and have seemingly different habits to ourselves.

People are fleeing their country because they are worried about the well-being of their families and our societies are materially and socially better off than theirs. So, whether we like it or not, people will keep looking at what they can have. They will keep fleeing and looking for a better life.

The only way to solve this issue is to help them build a society as good as ours.

If people were happy at home, they wouldn’t want to leave it...

Want more?

Want to find out in what way basic comfort impacts our quality of life? We got you covered! Find out more about basic comfort and feeling at ease."

["post_title"]=>

string(52) "Migration, an economic asset to an ageing population"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(24) "migration-economic-asset"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 15:08:32"

["post_modified_gmt"]=>

string(19) "2020-05-20 13:08:32"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.happonomy.org/creativity/migration-economic-asset/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[3]=>

object(WP_Post)#10183 (24) {

["ID"]=>

int(959)

["post_author"]=>

string(2) "35"

["post_date"]=>

string(19) "2015-05-12 00:00:00"

["post_date_gmt"]=>

string(19) "2015-05-12 00:00:00"

["post_content"]=>

string(9404) "Are you regularly working overtime? If so, are you being paid for it?

The chances are that many of you reading this article are working hard and not getting paid for your overtime, while, at the same time there will unfortunately be a large number of readers who are unemployed.

How did we end up living in a society where so many of us are either unemployed or working more hours than we are paid for?

Let’s investigate a simple story to dig a little deeper into this problem:

Imagine you are working in the light bulb industry. There are a couple of light bulb factories that, when combined, make just as many light bulbs as the world needs. You, and all your fellow factory workers, work eight hours per day. One day, someone makes an invention that allows the same number of factory workers to produce twice as many light bulbs as before. Since enough light bulbs are already being produced to meet the world’s demands, any sensible person would come to the obvious conclusion that you and your colleagues now only need to work four hours per day?

Well, if this scenario occurred in our actual world, you would probably continue to work eight hours a day. This just seems to be the way we do things, whether it makes sense or not.

The result is that too many light bulbs would be produced, half of the factories would go bankrupt, the majority of workers in the remaining factories would lose their jobs and the “lucky employees” would end up working more than eight hours per day, most likely without being paid for their overtime.

Why we work for free

Every day millions of people

work for free in the form of

unpaid overtime. Employers worldwide are feeling the pressure to achieve maximum productivity from their existing workforce and employees are willing to do what it takes to keep the jobs they have, as for many the only alternative is unemployment.

I’m sure I don’t have to explain the

negative effects that overtime can have on employees, both mentally and physically. Of course hiring more staff will mean higher labour costs for companies, but just think about the

financial consequences of the stress that will take its toll on overworked employees sooner or later. Surely the expression “

prevention rather than cure” makes sense here.

How productive we are when working 60 hours a week compared to 40 hours a week.

How productive we are when working 60 hours a week compared to 40 hours a week.

Redistribution of overtime

You might be curious just how many new jobs could be created with all the overtime being worked.

For instance, in Spain in 2012, they could have created

72,000 jobs with the total unpaid overtime that Spanish employees were working.

In the US, a quarter of all employees are working one hour of overtime per week, which is enough to fill

50,000 jobs. Imagine how much higher this number would be if all the employees that are working more than just one hour of overtime per week were included in these statistics as well.

President Obama has promised an

executive order that will make around half of America’s salaried employees

eligible for overtime pay. Some believe that the consequences of this reform will be disastrous, with many employers forced to cut jobs. Many others believe that it can only have positive effects. If corporate America doesn't want to pay their workers “time and a half” for their overtime, it would need to hire hundreds of thousands of additional workers, consequently

slashing the unemployment rate.

Reclaiming your work/life balance

Fortunately, more

awareness about overtime issues is being raised around the globe, through initiatives such as “

Go Home On Time Day” in the

UK and

Australia, helping people reclaim their work/life balance.

Influential magazines are writing articles about the subject and offering their readers

advice on how to improve their work/life balance, showing that they acknowledge the problem and want to help address it and create more awareness.

Solutions are taking shape, even on a higher level . Germany is considering introducing a

work-related stress law, a great initiative towards a better work-life balance for German workers.

What can employers start doing right now to break the chain?

First of all, it is important for companies to gain an

understanding of volume and demand profiles, in order to plan working time more accurately.

There are various types of

workplace management software on the market that can help companies design shift patterns to reallocate resources which meet the highs and lows in demand, consequently leading to a reduction in the need for overtime.

Demand-led rosters can be implemented in companies with a fluctuating demand for labour. Having flexible labour resources ensures that demand can always be met without the need for excessive overtime.

Masterclasses in employee resourcing can help to optimise a company’s workforce in a way that benefits both employers and employees.

Another important step is the realisation that hiring more staff is actually an

indication of success, allowing a company to continue to operate at a productive pace without wearing out existing staff and decreasing productivity.

Value your time

We can all contribute to a positive change, by

valuing our own time. If Facebook COO Sheryl Sandberg can

leave the office at 17.30 every day to have dinner with her kids, then so can you.

Managers can

lead by example, by leaving on time, taking regular breaks and encouraging their staff to do the same.

Reward employees for their productivity instead of their hours worked, and remind them that the best way to get more done is to

spend more time doing less.

If we have the desire to change our unbalanced work culture then we should be able to achieve it.

Extra reading:

Are you curious how well your country is doing when it comes to work-life balance and issues such as unpaid overtime?

http://www.oecdbetterlifeindex.org/topics/work-life-balance/

Want more?

Why do you work? Do you know the answer to that question? Maybe you get up every morning for financial security or because you want to connect to people. Or is it because you want to grow? Find out your answer by using the Happonomy Value Canvas!"

["post_title"]=>

string(19) "Abandoning Overtime"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(19) "abandoning-overtime"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 15:01:08"

["post_modified_gmt"]=>

string(19) "2020-05-20 13:01:08"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(56) "https://www.happonomy.org/creativity/abandoning-overtime/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "2"

["filter"]=>

string(3) "raw"

}

[4]=>

object(WP_Post)#13724 (24) {

["ID"]=>

int(955)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2015-04-22 00:00:00"

["post_date_gmt"]=>

string(19) "2015-04-22 00:00:00"

["post_content"]=>

string(11775) "Money.

You use it on a daily basis. Today in many ways it sets the difference between a life of struggle and a life of joy and abundance. And yet, very few people think about the function of money, let alone how it comes into existence.

Unlike natural resources which today are still limited in supply, money is a human invention with potential unlimited availability.

As a consequence, we are free to determine how much money exists, who receives it, who makes it and what it means to us.

Money and

our entire monetary system is a convention.

How is money created today?

Asking this question is actually asking the wrong question. Money in its generic form doesn’t really exist, only currencies do.

The number of currencies is unknown as a group of people as small as two persons could come up with their own currency and consider it a valid method of payment amongst each other. With the rise of internet technology, virtual currencies like Bitcoin are coming and going.

An exhaustive list of currencies considered to be a legal tender - basically government supported currencies - does exist though. At the time of writing there were

180 government supported currencies.

The importance of a currency is hence the number of people willing to accept it and which authority they attribute to the currency.

Back to the original question: asking how money is created today is hence asking how a specific currency is created.

For the sake of this article, we will not look into the private or alternative currency systems as a wide array of systems exists, ranging from

‘mining’ for bitcoins, basically solving complex math problems, to

time based currencies who just use time as a unit of currency: one hour of work is one credit.

Our focus are the currencies that are used as a legal tender as today they are the central currencies that facilitate trade between people.

How are currencies that hold legal tender created today?

You might think of coins minted and bank notes printed when you think of money that is created by the government. After all, that is what people use on an everyday basis to purchase goods and services.

You might even think money electronically available in your bank accounts is the number of those coins and notes that the bank holds for you.

The reality is different. For instance, in the UK , only 3% of our entire money supply - the total amount of money in circulation - is coins and bank notes. The

other 97% is created by the banking system in the form of debt. These percentages are common because of the nature of the system that is used.

When a bank makes a loan - for example to a person looking for a mortgage to buy a house - it does not give that person the amount of money in cash. Instead, the bank adds the number into a computer and the amount shows up in that person's bank account. In effect, new money was created.

If the person uses the deposit (for instance to buy a house) and transfers this money to the bank account of the seller, the bank of the seller can lend out a percentage of that amount. Meaning that from the initial loan banks can create new loans. This is called fractional reserve banking.

The percentage is determined by the

required reserve ratio, basically a percentage of money banks need to keep ‘in-house’. That percentage determines how much extra money can be created.

A simple table shows to illustrate how loans are leverage to create new money. Let us apply a reserve ratio of 20%.

It would take 82 of these transactions to reach the maximum of money that can be created, being 500.000. An easy formula can be applied to calculate the money creation power. Take the amount of the initial loan (100.000) and multiply it with the number you get when dividing one with the required reserve ratio (1/20% = 5)

In case you are curious what the required reserve percentage is…

it varies wildly: Western countries such as Australia and Canada do not have any reserve, the EU has a reserve requirement of 1%, the US an average of 3.1%.

With the fast growing economies, Russia trails with a 4%, Brazil leads with a reserve requirement of 20%, closely followed by China which set the reserve at

18.5%

Sovereign money creation, an alternative?

On a technical level much can be said about the value and the disadvantages of this system. Depending which perspective you take, you may consider this system to create

instability or growth.

The more fundamental question to ask though is

who is entitled to create money, not only coins and notes but also, and especially, the digital form of money.

In the fractional banking system as described above, the control of ‘digital money’ is primarily placed with two parties: the central bank committee who decides on the money creation policies and the commercial banks who are able to create money via the practice of lending, limited by the reserve ratio.

There are two points of attention to consider: first, the monetary policies coming out of the central bank are put in place by people who have not been publicly mandated.

Second, commercial banks are privately owned entities who aim to maximise profits, meaning private interests prevail over public interests.

It would be too easy to label this choice as an outrage. It is a system that has brought us forward, albeit with many flaws and inequalities.

That being said, the question that arises, can we improve it?

Assuming we agree the monetary policies need to support the quality of life of everybody, from beggar to investor, the idea of sovereign money creation is appealing. Sovereign money creation puts the responsibility of all money creation, not only the minting of coins and printing of paper, into the hands of the elected government.

The main advantage is clear: policy and money creation are in the same hands. Apart from an increased democratic legitimacy, there is also increased accountability for the actions of politicians who cannot hide behind ‘the markets’.

This shift would also reinstate power from those markets to the actual policy makers. Too often, politicians are impacted by financial markets and private interests in their policy decisions. Bringing the money creation into the hands of a government would put politicians back in control.

The pitfall and its solutions

Of course, there also lies the potential pitfall. Democracy is not always leading to the most optimal results, Hitler was elected democratically.

What if an elected government would abuse their power to create money? This would both have domestic and international impact.

Solutions to prevent this do exist:

- Governments need to indicate on which policies they will spend the money in beforehand.

- The Central Bank or any financial body with the required economic expertise, can formally review this, to assess the impact it will have on our economy.

- A monthly or quarterly review can be done to assess to what extent the results of the money creation lie in line with the policy goals set.

What happens with the bankers?

In a sovereign money creation system, commercial banks would lose their possibility to create money through loans.

Does this mean commercial banking is dead and bankers cannot earn any money?

Of course not.

Financial markets and financial products would still be there for banks to profit from.

Governments could fiscally or financially reward commercial bankers for acting in a way that supports the policy goals set, aligning the public good with private interests.

In short, there are plenty of ways to ensure commercial banks can thrive under a sovereign money creation system. Obviously this approach focuses solely on the economic dimension.

It does not take into account any psychological impact this has on people working in the banking system…

Where are we today?

Public support for the idea of sovereign money creation is growing, even from people intimate with the existing system.

For instance, chief economics commenter of the Financial Times, Martin Wolf,

pleas to stop commercial banks from creating money.

More importantly, the government of Iceland has effectively

put up a legal bill to end the current system where private banks create money via loans and transfer all money creation authority back to the Icelandic central bank.

Opposition to the idea exists as well. The main objection that less credit would hinder innovation and growth.

Breaking it down to its essence

In conclusion, let’s take a step back from the technicality of the system.

The central question one needs to ask is not a question of money creation. Rather it is which society do we want and to whom do we give control to create it.

And even more important, do we need debt to innovate?

Do you want it to be a private system or a publicly controlled system?

Do you prefer an elected government or a non elected body of experts to be in control? Or maybe both?

Money today is the fuel of our societal progress. At this time in history, it is too important not to care...

Want more?

In the mood for more food for thought? We redesigned our money system in a way that it supports our quality of life. We call it the Sustainable Money System. Do you want to find out more about it? Go explore the model!"

["post_title"]=>

string(48) "Sovereign Money Creation - A Better Way Forward?"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(24) "sovereign-money-creation"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 14:58:22"

["post_modified_gmt"]=>

string(19) "2020-05-20 12:58:22"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.happonomy.org/creativity/sovereign-money-creation/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "1"

["filter"]=>

string(3) "raw"

}

[5]=>

object(WP_Post)#13718 (24) {

["ID"]=>

int(951)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2015-04-03 00:00:00"

["post_date_gmt"]=>

string(19) "2015-04-03 00:00:00"

["post_content"]=>

string(8159) "Economics and business are fundamentally based on

conventions between humans.

Take a second to reread the above phrase to understand its impact. In short, it means that

economics is not an exact science like biology, chemistry or physics. This also means that we have the power to change an existing system if we

choose to do so.

Why double bookkeeping is flawed

At the core of business and economics is our

accounting system which registers the value created and the cost made to create this value. Today the large majority of businesses operate in a

double-entry bookkeeping system.

Double bookkeeping registers two parts: the financial cost of a production factor, whether that is labour, an item or service or the cost of money itself. On the other side of the balance sheet you can find the value created from sales and financial returns.

At the core

this type of accounting is limited. It does not take into account costs of the impact the production has on people and our environment, the so called ‘

externalities’.

What if we insert externalities into the accounting system?

Most people understand the concept of negative externalities, for instance when we talk about pollution. Polluting companies don’t incur a financial cost for the air or water pollution they create, even though our environment has been negatively impacted during the production process.

Positive examples of externalities also exist. Take an organisation employing people with a disability. It might either be less efficient or generate less profit than an organisation which doesn’t employ disabled people.

However, the first organisation creates excess monetary value by activating people who may not necessarily find a job elsewhere and would cost society extra in unemployment benefits.

Today, by discounting externalities, our economies are modelled to focus on financial gain and not on value maximisation.

Laws obviously try to compensate by incorporating restrictions to unregulated enterprises. Too many times though, laws are too little or too late, both because of lobbying efforts and because one cannot foresee all scenario’s that require prevention.

Triple accounting to the rescue?

What if we were to remodel our economies to take these externalities into account?

Triple Accounting, also known as

Triple bottom line (or TBL or 3BL), is the accounting concept that does exactly that. The accounting framework takes into account a social, ecological and financial dimension.

An important - but not insurmountable - obstacle is the

measurement of a Triple Accounting based system

. Do you measure everything in money? If you do, how much value do you assign to an acre of land or clean air?

The solution lies in making conventions. The GAAP, generally agreed accounting principles, which we use today also is a set of conventions, which also differ from country to country.

So, by modifying accounting laws, triple accounting can be implemented. In a second phase, taxation and subsidies on the triple accounting results could incentivise organisations to focus on value maximisation instead of profit maximisation.

How could governments make this work?

Since

accounting is based on conventions, policy makers can determine to what extent they want to impose legislation as binding conventions.

Some examples that could inspire:

An employee that medically burns out – incur a cost of 5% of your yearly profits.

For people who need to work more than 40 hours overtime in a month, deduct 10% of the operational profits (EBITDA) off the month in which the overtime was required.

If you're using natural materials as production inputs when alternative production methods exist, deduce 50% off your operational profits if the original production investments are written off.

The main thing to take away is not so much the actual numbers but the fact that we can modify what we register to be of value.

Where triple bottom line accounting is today

It may come as a surprise that Triple accounting is already used in different contexts, both in public and private sectors.

If you're curious for some examples:

The United Nations has incorporated versions and parameters from the Triple Bottom Line principles to be able to

perform full cost accounting.

In some countries, legislation supporting TBL has been put to the table and reporting pilots have been conducted. Take a look at the

pilot annual report of this Australian government body.

Big corporations like

Nestlé or

Novo Nordisk are already using principles from Triple Bottom Line to determine if projects are worth pursuing, even though no legal framework compels them to do so.

Let that be the main argument against different criticisms focusing on the imperfect nature of the triple bottom line approach. Although it is not perfect, that doesn't mean that it doesn't have any value at all nor should it be discarded.

How can organisations start?

In case you want to test run triple bottom line principles but don’t know where to start, you can download an overview of

principles and a comprehensive

implementation manual, made available by the

Global Reporting Initiative.

Want more?

Like the article already mentioned: economics is not an exact science like biology, chemistry or physics. This means that we have the power to change an existing system if we choose to do so.

That means we also have the power to change the monetary system! How? Check out our Sustainable Money System!"

["post_title"]=>

string(29) "Triple Bottom Line Accounting"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(29) "triple-bottom-line-accounting"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2020-05-20 14:56:08"

["post_modified_gmt"]=>

string(19) "2020-05-20 12:56:08"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(66) "https://www.happonomy.org/creativity/triple-bottom-line-accounting/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "2"

["filter"]=>

string(3) "raw"

}

[6]=>

object(WP_Post)#13717 (24) {

["ID"]=>

int(946)

["post_author"]=>

string(2) "42"

["post_date"]=>

string(19) "2015-03-16 00:00:00"

["post_date_gmt"]=>

string(19) "2015-03-16 00:00:00"

["post_content"]=>

string(6889) "Thousands of lives have already been claimed by Ebola; health workers all around West Africa are fighting to treat and contain the disease not only without having been rewarded in months, but also at great personal risk. However, the IMF and World Bank are still claiming their million dollar debts from the affected countries, such as Sierra Leone and Liberia. One can only wonder if there is maybe something inherently immoral to this situation.

The biblically-inspired debt jubilee concept has become increasingly popular in the modern day society. The reason is simple: for more than a decade now, we have been faced with a crumpled global economy that has fallen into a deepening debt trap. Recent global disasters, such as the Ebola outbreak to the equation, only make things grimmer. So, the common souls seem to have found a solution with the potential of making us feel at ease, which is something truly essential in the world of Happonomy.

The Modern Debt Jubilee

The modern day concept of debt jubilee is derived from the Old Testament’s jubilee year and implies the

forgiveness of all debt obligations, like a new beginning, if you may. That is one appealing idea, isn’t it? Not having to worry about money, or at least thinking of it in more productive and economically encouraging terms, rather than simply as already foregone to someone else as a debt payment, is an appealing idea, isn't it?

It is some economists’ belief that the

restructuring of debt is the only viable solution to fixing the underlying issues behind today’s economy: too much debt, at both consumer and governmental levels. Therefore, whether we are talking about the forgiveness of excess mortgage and credit card debt in the USA, or about pledging for the forgiveness of Sierra Leone’s debt to the IMF, some believe that the potential of a debt jubilee is just as high.

The Morality of a Debt Jubilee

Let us look at some of the arguments that debt jubilee supporters bring to the table. First, a debt jubilee would lead to the

redistribution of money, whereby, instead of being used for debt payment, money is used for the purchase of goods and services. In simple terms, such behaviour would lead to economic growth. It is, indeed, much easier to grow from an already positive point rather than constantly worrying about the deepening debt slum.

Second, the debt jubilee is as much of a

moral concept as it is economical. There is nothing wrong with thinking of practical notions such as debt payment with a more principle-based mind set. However, some may say that morality has nothing to do with the economy. In a world of Happonomy, I beg to differ. There is a moral dilemma here and it is directly associated with the practicality of economic concepts. Take the Ebola outbreak that was mentioned in the beginning of this article. Wouldn’t better use be made of funds if they were dedicated towards the fight against Ebola or are they more valuable as a debt payment source to lenders?

On the other hand, debt forgiveness for those who were reckless enough to put themselves in such a situation in the first place, can also be seen as immoral and rather unethical.

Who is to say that a one-time free pass does not encourage future haste and recklessness? You can see now how we are not only faced with the viability of an economical solution to increasing debt, but also with that of a moral one.

Happy People

While debt forgiveness remains a foreign concept to many countries, societies and governments, there are some recent adopters. For example, Croatia has decided to forgive the debts of 60,000 poor citizens in an attempt to refuel the economy and trigger economic growth. Those with minimal household earnings will be able to qualify for the forgiveness of their debts to banks, telecom operators, utility companies and even the tax administration. How this measure will impact Croatia’s economic stability and growth is yet to be seen. Nevertheless, Croatia's political officials were clear about the “one-time” nature of this act of goodwill, regardless of its results.

Greece is another country who has dabbled with the idea of debt forgiveness, albeit with much more negative reactions. In the case of Greece, some may argue that the utter recklessness that brought the country into its dire situation should not be repaid through a debt jubilee.

There are numerous cases and situations that can be quoted here as possible scenarios for a debt jubilee. However, it is most important for you to give debt forgiveness the warranted attention as both an economical and moral concept, as it is a viable solution whereby all parties will eventually have something to gain. It represents a new beginning, a fresh start, a second chance and the ability to start over. These are all notions without which happy people cannot thrive, or even exist.

References:

Want more?

Want to know more about money? We got you covered! We designed a new and sustainable monetary system which would make debt jubilees a thing of the past. Go check it out!"

["post_title"]=>

string(46) "Debt Jubilee: A Moral Solution for the Economy"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(12) "debt-jubilee"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-16 11:29:46"

["post_modified_gmt"]=>

string(19) "2019-07-16 11:29:46"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(49) "https://www.happonomy.org/creativity/debt-jubilee/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

[7]=>

object(WP_Post)#13821 (24) {

["ID"]=>

int(928)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2015-02-17 00:00:00"

["post_date_gmt"]=>

string(19) "2015-02-17 00:00:00"

["post_content"]=>

string(5692) "We are entering the era of robots. They come in all forms and sizes, some humanoid, others not. One thing is for sure: they are here to stay. The impact of this evolution can hardly be overestimated as it touches us in many dimensions.

This article highlights

the economic impact of robots that enter the workforce and more specifically looks for an answer to a question that few people dare to ask: how can we pay for our social protection models if an ever increasing number of people lose their jobs to a robot and cannot find a decent job.

Why capitalists love robots

You may be sceptical about the rise of the robots in a professional context. You’ll find an abundance of examples which show that jobs can be replaced by technology. However, most importantly there is a very strong business case to be made in favour of “robo-labour”.

For starters, putting on our accounting glasses,

robots are assets while people are costs, something which from a financial perspective makes a huge difference. This means it is much easier to finance a robot via a bank loan as this actual robot can be used as collateral in case a loan cannot be repaid.

More importantly though robots come with distinct advantages that reduces both costs and makes management a lot easier. Let’s take a look of the main benefits:

A real capitalist only looks at profit maximisation. Which one of the two options would you prefer in your organisation, provided money and profit was your main driver? Robots 9 - Humans 0...

What does an economy of robots mean?

Let’s assume we evolve to an increasingly automated economy with fewer people required to keep the economy running. Add up a further explosion of people (estimated to grow to 10 billion in a few decades).

Simply put: more people, fewer jobs.

Clearly, this will pressure countries’ budgets to keep paying for unemployment benefits to a point where it is likely to become unsustainable, especially in Europe, a continent that prides itself on its social security.

Technology based taxation to the rescue?

There are only two things that are certain and that is death and taxes. Although we live in an era where both are now up for debate, taxes historically have been a method to correct inequality and build our societies.

If we choose to stay in a capitalist system and look for increased productivity, the need for corrections to the system will grow as many will otherwise end up in a life not worthy of the twenty-first century. At the time of writing a proposition was put to the US congress to significantly increase taxation of corporations to fund public projects.

Once the robot revolution is in full effect - and this will very likely be with corporations first - the pressure for these corrections will only increase as

many people will be driven towards unemployment significantly increasing the costs of social welfare.

One potential avenue policy makers can explore is the possibility of taxing organisations based on the number of robots companies operate. Yes, this means robots would need to be registered.

Alternatively, one could look into the ratio robots/humans in an organisation and link taxation levels with the following ratio’s: 30% people, 30% taxes.

Technology based taxation - a murky concept?

The problem with the above approach is obviously in the definition of both “robot” and “operational”. One doesn’t want to discourage the uptake of technology as an innovative tool either.

For instance, would you consider a 3D printer that is used once a week to be an operational robot? Does software constitute the kind of technology that should fall under the definition?

From our perspective, this question would open the need for an entire set of detailed regulations. At the core though, one question should frame the debate. Does the technology replace a human being for which the task that is executed is meaningful?

Alternatives to technology based taxation

The problem stays the same - how can we pay for a high-quality social security - but the answers can vary. From collectivizing robot resources to a basic income, all provide different takes to the answer. Or what if - just to tickle your brain - money was abolished completely.

Want more?

We could solve the robots-taking-over-your-job problem. Yes, seriously! And the solution would make you happy too. Curious? Go check it out!

"

["post_title"]=>

string(56) "Technology Based Taxation - A way to pay for the future?"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(25) "technology-based-taxation"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-15 14:52:48"

["post_modified_gmt"]=>

string(19) "2019-07-15 14:52:48"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(62) "https://www.happonomy.org/creativity/technology-based-taxation/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

}

["post_count"]=>

int(8)

["current_post"]=>

int(-1)

["in_the_loop"]=>

bool(false)

["post"]=>

object(WP_Post)#13723 (24) {

["ID"]=>

int(979)

["post_author"]=>

string(3) "547"

["post_date"]=>

string(19) "2017-07-03 00:00:00"

["post_date_gmt"]=>

string(19) "2017-07-03 00:00:00"

["post_content"]=>

string(1151) "If you are curious how

happiness, money and work influence each other, take a look at the TEDx talk of Bruno, the Happonomy coordinator.

Bruno also explores some types of solutions to realign work and money towards the quality of our lives and

upgrade our economy.

Want more?

Want more? Don't be sad that the video is over! We got plenty of other exciting stuff to share with you. Subscribe to our bi-monthly newsletter and we'll keep you up to date with our latest news!"

["post_title"]=>

string(41) "How capitalism can increase our happiness"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(4) "open"

["ping_status"]=>

string(4) "open"

["post_password"]=>

string(0) ""

["post_name"]=>

string(24) "capitalism-and-happiness"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2019-07-17 11:27:56"

["post_modified_gmt"]=>

string(19) "2019-07-17 11:27:56"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.happonomy.org/creativity/capitalism-and-happiness/"

["menu_order"]=>

int(0)

["post_type"]=>

string(4) "post"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

["comment_count"]=>

int(0)

["current_comment"]=>

int(-1)

["found_posts"]=>

int(17)

["max_num_pages"]=>

float(2)

["max_num_comment_pages"]=>

int(0)

["is_single"]=>

bool(false)

["is_preview"]=>

bool(false)

["is_page"]=>

bool(false)

["is_archive"]=>

bool(true)

["is_date"]=>

bool(false)

["is_year"]=>

bool(false)

["is_month"]=>

bool(false)

["is_day"]=>

bool(false)

["is_time"]=>

bool(false)

["is_author"]=>

bool(false)

["is_category"]=>

bool(false)

["is_tag"]=>

bool(true)

["is_tax"]=>

bool(false)

["is_search"]=>

bool(false)

["is_feed"]=>

bool(false)

["is_comment_feed"]=>

bool(false)

["is_trackback"]=>

bool(false)

["is_home"]=>

bool(false)

["is_privacy_policy"]=>

bool(false)

["is_404"]=>

bool(false)

["is_embed"]=>

bool(false)

["is_paged"]=>

bool(true)

["is_admin"]=>

bool(false)

["is_attachment"]=>

bool(false)

["is_singular"]=>

bool(false)

["is_robots"]=>

bool(false)

["is_favicon"]=>

bool(false)

["is_posts_page"]=>

bool(false)

["is_post_type_archive"]=>

bool(false)

["query_vars_hash":"WP_Query":private]=>

string(32) "fe01179d26003145d463d7ef36b98199"

["query_vars_changed":"WP_Query":private]=>

bool(true)

["thumbnails_cached"]=>

bool(false)

["allow_query_attachment_by_filename":protected]=>

bool(false)

["stopwords":"WP_Query":private]=>

NULL

["compat_fields":"WP_Query":private]=>

array(2) {

[0]=>

string(15) "query_vars_hash"

[1]=>

string(18) "query_vars_changed"

}

["compat_methods":"WP_Query":private]=>

array(2) {

[0]=>

string(16) "init_query_flags"

[1]=>

string(15) "parse_tax_query"

}

["tribe_is_event"]=>

bool(false)

["tribe_is_multi_posttype"]=>

bool(false)

["tribe_is_event_category"]=>

bool(false)

["tribe_is_event_venue"]=>

bool(false)

["tribe_is_event_organizer"]=>

bool(false)

["tribe_is_event_query"]=>

bool(false)

["tribe_is_past"]=>

bool(false)

["tribe_controller"]=>

object(Tribe\Events\Views\V2\Query\Event_Query_Controller)#12600 (1) {

["filtering_query":"Tribe\Events\Views\V2\Query\Event_Query_Controller":private]=>

*RECURSION*

}

}

string(10) "have posts"

Titel

Mollit duis Lorem amet veniam minim ad.Voluptate commodo labore aliqua quis esse aliqua.Veniam tempor elit velit non.

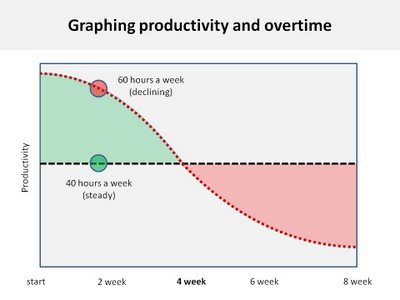

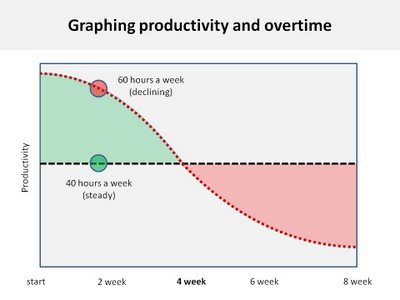

How productive we are when working 60 hours a week compared to 40 hours a week.

How productive we are when working 60 hours a week compared to 40 hours a week.

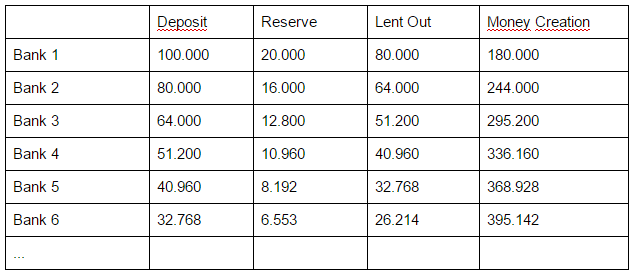

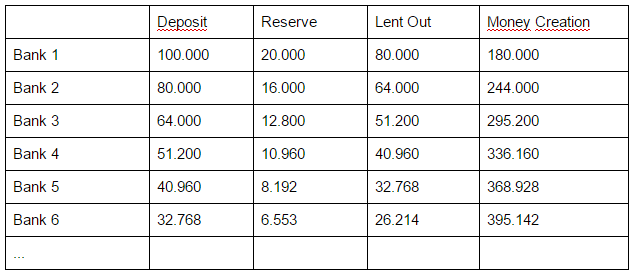

It would take 82 of these transactions to reach the maximum of money that can be created, being 500.000. An easy formula can be applied to calculate the money creation power. Take the amount of the initial loan (100.000) and multiply it with the number you get when dividing one with the required reserve ratio (1/20% = 5)

In case you are curious what the required reserve percentage is… it varies wildly: Western countries such as Australia and Canada do not have any reserve, the EU has a reserve requirement of 1%, the US an average of 3.1%.

With the fast growing economies, Russia trails with a 4%, Brazil leads with a reserve requirement of 20%, closely followed by China which set the reserve at 18.5%

It would take 82 of these transactions to reach the maximum of money that can be created, being 500.000. An easy formula can be applied to calculate the money creation power. Take the amount of the initial loan (100.000) and multiply it with the number you get when dividing one with the required reserve ratio (1/20% = 5)

In case you are curious what the required reserve percentage is… it varies wildly: Western countries such as Australia and Canada do not have any reserve, the EU has a reserve requirement of 1%, the US an average of 3.1%.

With the fast growing economies, Russia trails with a 4%, Brazil leads with a reserve requirement of 20%, closely followed by China which set the reserve at 18.5%

In a sovereign money creation system, commercial banks would lose their possibility to create money through loans.

Does this mean commercial banking is dead and bankers cannot earn any money?

Of course not.

Financial markets and financial products would still be there for banks to profit from.

Governments could fiscally or financially reward commercial bankers for acting in a way that supports the policy goals set, aligning the public good with private interests.

In short, there are plenty of ways to ensure commercial banks can thrive under a sovereign money creation system. Obviously this approach focuses solely on the economic dimension.

It does not take into account any psychological impact this has on people working in the banking system…

In a sovereign money creation system, commercial banks would lose their possibility to create money through loans.

Does this mean commercial banking is dead and bankers cannot earn any money?

Of course not.

Financial markets and financial products would still be there for banks to profit from.

Governments could fiscally or financially reward commercial bankers for acting in a way that supports the policy goals set, aligning the public good with private interests.

In short, there are plenty of ways to ensure commercial banks can thrive under a sovereign money creation system. Obviously this approach focuses solely on the economic dimension.

It does not take into account any psychological impact this has on people working in the banking system…

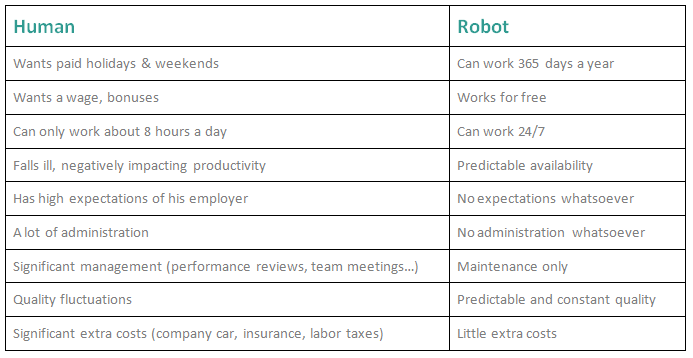

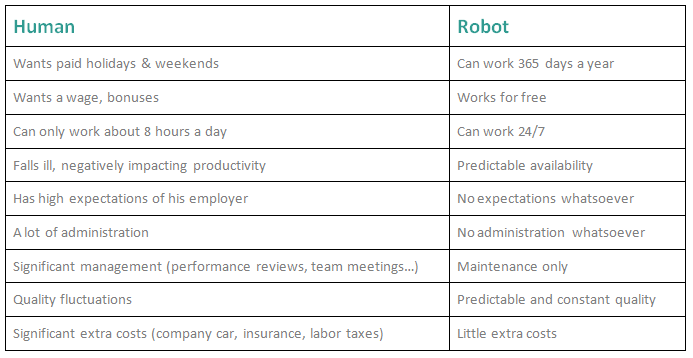

A real capitalist only looks at profit maximisation. Which one of the two options would you prefer in your organisation, provided money and profit was your main driver? Robots 9 - Humans 0...

A real capitalist only looks at profit maximisation. Which one of the two options would you prefer in your organisation, provided money and profit was your main driver? Robots 9 - Humans 0...

If we choose to stay in a capitalist system and look for increased productivity, the need for corrections to the system will grow as many will otherwise end up in a life not worthy of the twenty-first century. At the time of writing a proposition was put to the US congress to significantly increase taxation of corporations to fund public projects.

Once the robot revolution is in full effect - and this will very likely be with corporations first - the pressure for these corrections will only increase as many people will be driven towards unemployment significantly increasing the costs of social welfare.

One potential avenue policy makers can explore is the possibility of taxing organisations based on the number of robots companies operate. Yes, this means robots would need to be registered.

Alternatively, one could look into the ratio robots/humans in an organisation and link taxation levels with the following ratio’s: 30% people, 30% taxes.

If we choose to stay in a capitalist system and look for increased productivity, the need for corrections to the system will grow as many will otherwise end up in a life not worthy of the twenty-first century. At the time of writing a proposition was put to the US congress to significantly increase taxation of corporations to fund public projects.

Once the robot revolution is in full effect - and this will very likely be with corporations first - the pressure for these corrections will only increase as many people will be driven towards unemployment significantly increasing the costs of social welfare.

One potential avenue policy makers can explore is the possibility of taxing organisations based on the number of robots companies operate. Yes, this means robots would need to be registered.

Alternatively, one could look into the ratio robots/humans in an organisation and link taxation levels with the following ratio’s: 30% people, 30% taxes.